Suggested

-

health insurance

-

group personal accident

-

bike insurance

-

car insurance

-

cat insurance

-

check car details

-

health insurance plans

-

health cover plans

-

two wheeler insurance

-

2 wheeler insurance

-

renewal of car insurance

-

renew car insurance

-

car insurance renewal

-

car insurance renew

-

car insurance online

-

maruti suzuki car insurance

-

maruti suzuki insurance

-

maruti insurance

-

travel insurance

-

car no details

-

car number details

-

health insurance plans for family

-

medical insurance plans for family

-

best health insurance in india

-

good health insurance in india

Commercial Insurance

Bharat Laghu Udyam Suraksha

Key Features

Safeguard Your Business with Comprehensive Insurance Coverage

Coverage Highlights

Protect your assets by choosing the right insurance coverage

Suitable for

Small & medium businesses, offices, industrial risks, storage risks, shops & malls, hotels, warehouses, educational institutions, places of worship and more

Assets covered

Structure and building, plant and machinery, furniture and furnishings, raw materials, electric fittings, and finished goods and stocks, where sum insured is INR 5 crores to INR 50 crores in any one location

All-Round Protection for Your Business

Safeguard your enterprise against fire, explosion or implosion, natural calamities, terrorism, riots, strikes, malicious damage and more with a policy designed to keep your business running smoothly

Inclusions

What's covered?

Fire and Lightning

Coverage for damages from fire outbreaks and lightning strikes

Explosion or Implosion

Financial security against unforeseen explosions or implosions

Impact Damage

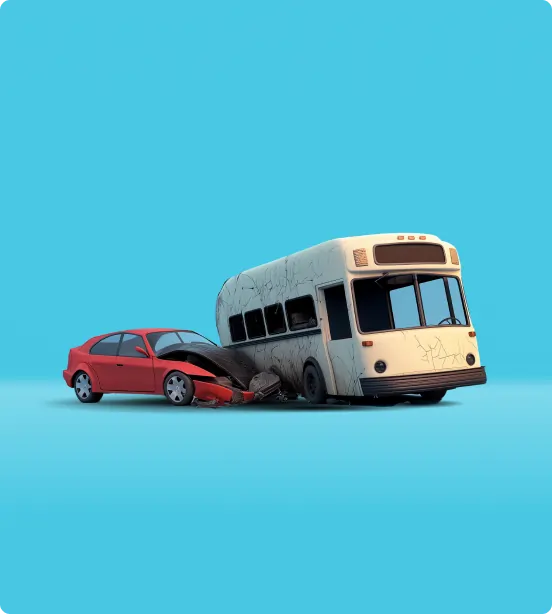

Protection from damages caused by external physical objects (e.g., vehicles, falling trees, walls)

Riot, Strike, Malicious Damage (RSMD)

Coverage for losses from riots, strikes, or malicious damage

Storm, Tempest, Flood, Inundation (STFI)

Protects against property damages caused due to storms, cyclones, tempests, tsunamis, floods and inundations

Missile Testing Operations

Coverage for losses due to missile testing operations

Theft

Coverage for theft within 7 days following an insured event

Earthquake, Bushfire, Forest or Jungle Fire

Protection against damages from earthquakes, bushfires, forest fires, or jungle fires

Terrorism Cover

Covers loss in case your property is damaged by a terrorist attack

Waiver of underinsurance

Underinsurance waived upto 15% as part of standard cover

Note

Please read policy wording for detailed inclusions

Exclusions

What's not covered?

Deliberate Acts

Losses from deliberate acts by the insured or representatives

Electronic Equipment Damage

Excludes damages caused by over-running, pressure, short-circuiting, arcing, self-heating, or electricity leakage

Cold Storage Stock Damage

No coverage for stock losses due to temperature fluctuations

Process Interruption Spoilage

Excludes spoilage losses resulting from process interruptions due to an insured event

War and Nuclear Risks

Losses arising from international war, invasion, civil war, rebellion, revolution, insurrection, or nuclear contamination are excluded

Pollution or Contamination

Excludes losses due to pollution or contamination unless directly caused by an insured event

Property Removed from Premises

Excludes losses incurred due to removal of property unless under specific circumstances (e.g., machinery temporarily taken for repairs)

Excess

5% of claim amount subjected to min INR 10,000 (Other than Terrorism)

Note

Please read policy wording for detailed exclusions

Additional Covers

What else can you get?

Accidental Damage Cover

Covers accidental damage to property or contents, like spills or breaks

Electrical / Electronic Appliance Clause Cover

Covers damage to appliances from electrical faults or power surges

Impact Damage Cover

Covers damage from physical impacts, like a car or tree hitting your property

Snow Damage Cover

Covers damage from snow, like roof collapse or falling ice

Minor Works

Small, quick, and inexpensive construction or renovation projects.

Escalation Clause

Allows contract price increase if material or labor costs rise

Waiver of Involuntary Improvement

Protects against paying for unauthorized property improvements

Immediate Repairs

Insured may immediately begin repairs or reconstruction work of the insured property so that the normal operations return back to normal

Floater Cover for Stocks

Under one sum insured, avail cover for the stocks at multiple locations

Declaration Policy for Stocks

As per the declaration basis, a cover is offered for the regular fluctuations in stock values and stocks

Benefits You Deserve

At-A-Glance

Compare business insurance plans made for you

| Feature |

Bharat Sookshma Udhyam Fire |

Bharat Laghu Udhyam Fire |

Standard Fire & Special Perils |

|---|---|---|---|

| Suitable For | Micro and small enterprises | Small and medium enterprises (SMEs) | For businesses like Large commercial and industrial establishments |

| Sum Insured limits | Upto INR 5 Cr | From INR 5 Cr to INR 50 Cr | Above INR 50 Cr |

| Damage to Stucture, Contents & Stock | Covered | Covered | Covered |

| Explosion, Implosion, RSMD | Covered | Covered | Covered |

| Spontaneous Combustion | Covered | Covered | Can be opted |

| Basis of Sum insured | Reinstatement/Replacement Value Basis | Reinstatement/Replacement Value Basis | Reinstatement/Market Value Basis |

| Terrorism | Inbuilt Cover | Inbuilt Cover | Optional |

| Cover for Theft | Inbuilt (Within 7 days of occurrence of event) | Inbuilt (Within 7 days of occurrence of event) | Not covered |

| Underinsurance | Waived upto 15% | Waived upto 15% | Can be opted |

| Stock Declaration Clause | Covered | Covered | Can be opted |

| Coverage for Stocks on floater basis | Inbuilt | Optional | Optional |

| Removal of Debris Coverage | Covers upto 2% of the claim amount | Covers upto 2% of the claim amount | Covers expenses in excess of 1% of the claim amount |

| Architects, Surveyors, and Consulting Engineers' Fees | Covers fees upto 5% of the claim amount | Covers fees upto 5% of the claim amount | Covers fees in excess of 3% of the claim amount |

Why Bajaj Allianz?

view allDownload Policy Document

Get instant access to your policy details with a single click.

Trusted Risk Advisor

Mobile Self Risk Assessment

PRIME Inspection app helps to evaluate quality of your property (Shop, Office, Plant or Others) having SI upto INR 50 crs. It is simple to navigate having multiple Q & A designed for client

Instant Generation of Risk Report

It helps Provide Risk Recommendations, Risk Quality Rating (RQR), Peer Comparison & GAP Analysis for the client

Frequently Bought Together

View AllStep-by-Step Guide

To help you navigate your insurance journey

How to Buy

-

0

Visit the Bajaj Allianz General Insurance website

-

1

Fill in the lead generation form with accurate details

-

2

Get quote, make payment and receive the policy documents

How to Renew

-

0

Contact the Policy Issuing Office

-

1

Review expiring policy and share necessary details

-

2

Receive renewal quote

-

3

Make renewal payment

-

4

Receive the renewed policy documents via email

How to Claim

-

0

Contact us through our customer service touchpoints

-

1

Submit the claim form along with the necessary documents

-

2

Provide details of the incident and any supporting evidence

-

3

Cooperate with the claims investigation process

-

4

Receive the claim settlement as per the policy terms

Know More

-

0

For any further queries, please reach out to us

-

1

Phone +91 020 66026666

-

2

Fax +91 020 66026667

Quick Links

Diverse more policies for different needs

Insurance Samjho

Critical Illness Insurance

Health Claim by Direct Click

Personal Accident policy

Global Personal Guard Policy

Claim Motor On The Spot

Two-Wheeler Long Term Policy

24x7 Roadside/Spot assistance

.webp)

Caringly Yours (Motor Insurance)

Travel Insurance Claim

Cashless Claim

24x7 Missed Facility

Filing a Travel Insurance Claim

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

Explore our articles

View all

Create a Profile With Us to Unlock New Benefits

- Customised plans that grow with you

- Proactive coverage for future milestones

- Expert advice tailored to your profile

What Our Customers Say

Affordable

Sookshma Udhayam Fire Insurance is an excellent choice for small businesses like mine. The policy is affordable and covers fire damage comprehensively.

Ravi Sharma

Mumbai

22nd Jan 2025

Smooth Claim

I had a fire accident in my small shop, and Sookshma Udhayam Fire Insurance covered the damages efficiently. The claim settlement was smooth, and I received my compensation quickly.

Sunita Rao

Chennai

18th Nov 2023

Quick Processing

One of the best fire insurance policies for small businesses. The terms are clear, and they don’t have hidden charges.

Manoj Patil

Pune

11th Aug 2023

Affordable

Affordable and reliable fire insurance for small businesses! The coverage is impressive, and the premium is pocket-friendly.

Vikas Thakur

Hyderabad

26th Feb 2023

Best Coverage

This fire insurance is perfect for small businesses. The coverage is comprehensive, and the process of buying the policy was smooth. Their team answered all my queries patiently.

Rajesh Nair

Kochi

13th Aug 2023

Smooth Buying

As a small café owner, I wanted a fire insurance policy that was affordable yet effective. Sookshma Udhayam Fire Insurance met my expectations.

Meenal Joshi

Ahmedabad

13th Aug 2023

FAQ's

This policy covers losses due to fire, lightning, explosion, and implosion. It also includes coverage for damage caused by riots, strikes, malicious acts, storms, floods, and earthquakes. Business owners can ensure financial security against property damage and can add extra coverage for additional perils as required.

This policy covers losses due to fire, lightning, explosion, and implosion, including coverage for damage caused by riots, strikes, malicious acts, storms, floods, and earthquakes. Business owners can add extra coverage for additional perils as required.

This policy covers damages or losses caused by fire, lightning, explosion, aircraft damage, riots, strikes, malicious damage, natural calamities, impact damage, subsidence, landslide, bursting/overflowing of water tanks, leakage from sprinkler installations, missile testing operations, and bush fires.

Yes; stocks and inventory stored within insured premises are genreally covered against fire-related damages. Businesses can opt for additional coverage to protect against theft or spoilage due to perils like floods or storms. The sum insured should be accurately calculated to ensure adequate compensation.

Yes, the policy can be enhanced with add-ons such as debris removal, professional fees, spontaneous combustion, cold storage deterioration, spoilage material damage, and more.

Property insurance generally covers losses due to fire, lightning, explosion, implosion, riots, strikes, malicious acts, storms, floods and earthquakes. Additional coverage for other perils can often be added as needed.

Yes, loss of rent can be covered as an add-on. If the insured property becomes uninhabitable due to a covered peril, the policy may compensate for lost rental income, providing financial stability during property restoration.

Yes, stocks and inventory stored within insured premises are typically covered against fire-related damages. Additional coverage can be opted to protect against theft or spoilage due to perils like floods or storms.

Property insurance can cover various types of properties, including residential homes, commercial buildings, industrial facilities, and rental properties. Each type of property may have specific coverage options tailored to its unique risks.

Yes, property insurance typically covers natural disasters such as earthquakes, floods, and storms. However, coverage for certain natural disasters may need to be added as an addition to the standard policy.

In case of a loss, notify the insurer immediately and provide details of the damage. Submit supporting documents like incident reports and any other required document. A surveyor will assess the loss, and once approved, the claim will be settled as per policy terms.

The time to settle a claim can vary depending on the complexity of the claim and the documentation provided. Generally, it can take anywhere from a few weeks to several months.

If your claim is denied, review the denial letter to understand the reasons. You can appeal the decision by providing additional evidence or documentation to support your claim.

Yes, many property insurance policies include coverage for additional living expenses if the insured property becomes uninhabitable due to a covered peril, This can cover temporary accommodation costs.

A deductible is the amount you are responsible for paying out of pocket before the insurance coverage kicks in. It is usually specified in the policy and can affect the premium amount.

Property insurance policies are typically renewed annually. It's important to review your coverage and make any necessary adjustments at each renewal.

You can’t switch insurers at the time of renewal, but you can opt for a different insurance policy with a new insurer if you feel it’s necessary.

If you miss the renewal date, your coverage may lapse, leaving your property uninsured. Some insurers offer a grace period, but it's best to renew on time to avoid any gaps in coverage.

Yes, you can make changes to your policy at renewal. This includes adjusting coverage limits, adding or removing coverage, and updating any information about the insured property.

Premiums can change at renewal based on various factors, including changes in coverage, claims history, and any updates to the insured property. It's important to review the renewal terms carefully.

Why juggle policies when one app can do it all?

Download Caringly your's app!

Bajaj Allianz Bharat Laghu Udyam Suraksha Policy

Protect Your Business Against Troubled Times With Sum Insured of Rs. 5 crores to Rs. 50 crores Uncertainty never rings the doorbell. Every business is vulnerable to various risks and contingencies. Although we cannot predict what will happen tomorrow, we can always be prepared. Hence, comprehensive insurance coverage for any type of business becomes crucial. You are protecting your assets by choosing the right business insurance coverage.

The Bajaj Allianz Bharat Laghu Udyam Suraksha Policy offers optimum care in the form of insurance protection to your business, allowing you to concentrate on its prosperity. Be at ease as your insured property is in our care hands.

What is Bajaj Allianz Bharat Laghu Udyam Suraksha Policy?

The Bajaj Allianz BLUS insurance policy offers a cover for any physical loss, damage, or destruction caused to the property insurance due to an untoward incident in the policy term. A cover is also offered for damage or destruction to the plant and machinery, building and structures, stock and any business-related assets.

When opting for the Bajaj Allianz Bharat Laghu Udyam Suraksha Policy you get to avail the listed below benefits:

- ● Underinsurance waived off till 15%

- ● Theft cover within 7 days of event occurrence

- ● Provides In-built covers

- ● Start-up expenses

- ● Removal of debris

- ● Professional fees

- ● Temporary removal of stocks

- ● Stocks on a floater basis

- ● Additions, alterations, or extensions

Let us understand the importance of underinsurance with the below two instances:

You have taken Bajaj Allianz Bharat Laghu Udyam Suraksha Policy for a Sum Insured of Rs. 50 crores which was the value at risk at the insurance commencement date. The value at risk of insurable items at the time of loss is found as Rs. 57 crores. There is a loss of Rs. 10 crores. Underinsurance works out to 12.28%. Since it is less than 15%, we will consider the full claim of Rs. 10 crores for payment subject to deduction of excess and other adjustments as per the independent surveyor. Your claim value will be as per the terms and conditions of the Bajaj Allianz BLUS Policy.

Or

Your shop has Bajaj Allianz Bharat Laghu Udyam Suraksha Policy. You have insured the structure for Rs. 30 crores and stock for Rs. 10 crores. The actual value of the structure is Rs. 32 crores and of stock is Rs. 16 crores. The stock of Rs. 50 lakhs are burnt in a fire. The total insured property has underinsurance of 16.67% that we cannot waive. We could consider your claim for payment of Rs. 41.67 lakhs only (83.33% of Rs. 50 lakhs) subject to the deduction of excess and other adjustments as per the independent surveyor. Your claim value will be as per the terms and conditions of the policy.

*T&C apply

Eligibility Criteria for Bharat Laghu Udyam Suraksha Policy

Anyone who has Small and Medium Enterprises/Businesses should opt for Bajaj Allianz Bharat Laghu Udyam Suraksha Policy. A quick understanding to whom this policy can be issued:

- ● The Bajaj Allianz BLUS policy offers a cover to the insured property that is related to the business. Here, the total value at risk across the insurable asset should exceed Rs. 5 crores but not more than Rs. 50 crores.

- ● If there is more than one person that is insured within the policy then each of you is going to be the joint policyholder.

- ● Besides, in case the insured property is hypothecated, mortgaged, or pledged, the policy will show the ‘Agreed Bank Clause’ and the name of the bank. This clause implies a specific amount that is agreed between the insurance company and the insured for the items whose value cannot be ascertained.

Who Needs Bharat Laghu Udyam Suraksha Policy?

The Bajaj Allianz BLUS insurance policy can be bought by any individual who owns the below:

- ● Offices

- ● Shops

- ● Hotels

- ● Industrial/Manufacturing risks

- ● Utilities located outside the compound of industrial/ manufacturing risks

- ● Tank farms/gas holders outside the compounds of industrial/manufacturing risks

- ● Storage risks outside the compound of industrial/manufacturing risks

Why you should Buy Bharat Laghu Udyam Suraksha Policy?

- ● Leading private General Insurance Companies in India

- ● Team of Expertise in Risk Mitigation

- ● Customer-centric Approach

- ● Value Added Services

- ● 24x7 Customer Support

- ● Convenient, Instant and Innovative Solutions

With the examples below, let us understand the importance of a BLUS insurance policy:

- ● Rohit is running his shop of garments. One day his shop catches fire due to a short circuit. Due to this fire incident, Stock, Furniture and Buildings are affected. Rohit has a Bajaj Allianz BLUS policy covering Stock, Building and Furniture. In this case, we will pay the claim amount to Rohit as per the loss assessed by an independent IRDAI-licensed surveyor. This will be as per the terms & conditions of the Bajaj Allianz BLUS Policy.

- ● Sachin is running a manufacturing business of corrugated boxes. One day his manufacturing location is affected because of flood/inundation. Due to this flood/inundation, Stock, Plant & Machineries and furniture are affected. Sachin has a Bajaj Allianz BLUS policy covering Stock, Plant & Machineries, and Furniture. In this case, we will pay the claim amount to Sachin as per the loss assessed by an independent IRDAI-licensed surveyor. This will be as per the terms & conditions of the Bajaj Allianz BLUS Policy.

Inclusions Under Bajaj Allianz Bharat Laghu Udyam Suraksha Policy

Let us now know the events covered under the Bajaj Allianz Bharat Laghu Udyam Suraksha Policy:

- ● Fire, including due to its own fermentation, spontaneous combustion, or natural heating

- ● Explosion or Implosion

- ● Lightning

- ● Earthquakes, volcanic eruption, or other convulsions of nature

- ● Storms, Typhoon, Tornado, Cyclone, Tsunami, Hurricane, Tempest and Inundation

- ● Subsidence of the land on which your premises stand, Landslide, Rockslide

- ● Forest fire, Bush fire, and Jungle fire

- ● Impact damage of any kind, that is damage caused by impact of, or collision caused by, any external physical object (vehicle, falling trees, aircraft, wall, etc.)

- ● Missile testing operations

- ● Strikes, Riot and Malicious Damages

- ● Acts of terrorism

- ● Bursting or overflowing of water tanks, apparatus and pipes

- ● Leakage from automatic sprinkler installations

- ● Theft within 7 days from the occurrence of, and proximately caused by, any of the above

*T&C apply

Note: For complete information, please refer to the policy wording carefully.

Exclusions Under Bajaj Allianz Bharat Laghu Udyam Suraksha Policy

Listed below are the situations for which do not offer a cover or pay for any loss or damage:

- ● Your deliberate, willful, or intentional act or omission, or of anyone on Your behalf, or with consent

- ● Missing or disappearance of property

- ● War, invasion, the act of foreign enemy hostilities or war-like operations

- ● Pollution or contamination

- ● Any consequential or indirect loss or loss of income/wages/earning

- ● Loss, destruction, or damage to the stocks in cold storage premises due to temperature change

- ● Insured building remains continuously unoccupied for more than 30 days

- ● Damage to bullion or unset precious stones, any curios or works

- ● Property covered under a marine policy

- ● Costs, fees, or expenses for preparing any claims

- ● Ionising radiation or contamination by radioactivity

*T&C apply

Note: For complete information, please refer to the policy wording carefully

Standard Add-ons Under Bajaj Allianz Bharat Laghu Udyam Suraksha Policy

With the Bajaj Allianz BLUS insurance policy, you can include the below add-ons upon payment of additional premium payment:

Floater Cover:

Under one sum insured, avail covet for the stocks at multiple locations

Declaration Policy for Stocks:

As per the declaration basis, a cover is offered for the regular fluctuations in stock values and stocks.

*T&C apply

When it comes to the Bajaj Allianz BLUS insurance premium amount, it is determined by the below aspects:

- ● Nature of the business

- ● Nature of the property insured whether building, stock, plant, etc.

- ● Sum insured chosen

- ● Risk profile

The Bajaj Allianz Bharat Laghu Udyam Suraksha Policy offers comprehensive coverage against unforeseen events. A policy for every small, medium, and large business owner so that they remain worry-free in the long run.

Note: ‘BLUS’ is the acronym for Bharat Sookshma Udyam Suraksha Policy.