Suggested

-

health insurance

-

group personal accident

-

bike insurance

-

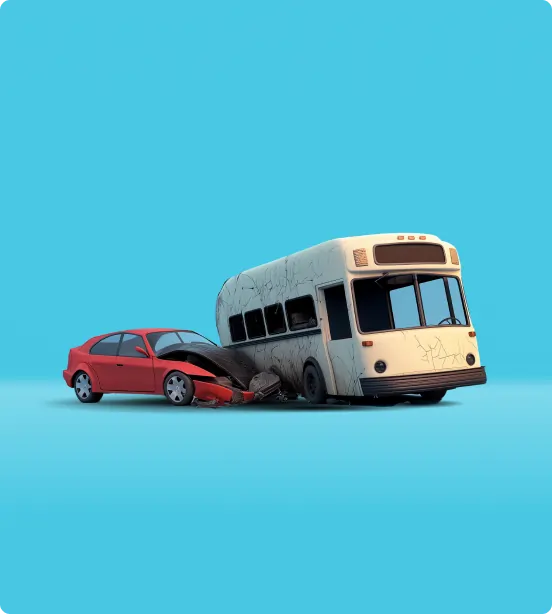

car insurance

-

cat insurance

-

check car details

-

health insurance plans

-

health cover plans

-

two wheeler insurance

-

2 wheeler insurance

-

renewal of car insurance

-

renew car insurance

-

car insurance renewal

-

car insurance renew

-

car insurance online

-

maruti suzuki car insurance

-

maruti suzuki insurance

-

maruti insurance

-

travel insurance

-

car no details

-

car number details

-

health insurance plans for family

-

medical insurance plans for family

-

best health insurance in india

-

good health insurance in india

Commercial Insurance

Comprehensive General Liability Insurance Policy

Key Features

One Policy, Total Protection

Coverage Highlights

Comprehensive coverage for your business

Coverage for Legal Liability

Provides coverage for legal liability arising from accidental bodily injury or property damage caused due to insured’s business operations

Defence Costs

Covers defence costs incurred with the insurer's prior written consent

Indemnity Limit

Includes a limit of indemnity, which is the maximum amount the insurer will pay for claims, including damages and defence costs

Personal & Advertising Injury

Covers defamation, copyright claim and privacy violations

Inclusions

What’s covered?

Bodily Injury & Property Damage Liability

Covers legal expenses and compensation if third parties suffer injury or property damage due to business operations

Personal & Advertising Injury

Protects against claims like defamation, copyright infringement in ads, and invasion of privacy

Medical Payments

Pays for medical expenses of third parties injured on business premises, regardless of fault

Products & Completed Operations Liability

Covers liability arising from defective products or completed services that cause harm

Tenant’s Legal Liability

Protects against claims for accidental damage caused to rented premises

Legal Defence Costs

Covers lawyer fees and court expenses related to covered liability claims

Business Operations

Applies to claims arising during your business operations

Exclusions

What’s not covered?

Deliberate Non-Compliance

Claims arising from deliberate non-compliance with statutory provisions are not covered

Loss of Goodwill or Market

Loss of goodwill or market value is not covered

Contractual Liability

Claims arising from contractual obligations or guarantees are not covered

Pollution

Claims related to pollution or environmental damage are not covered

Fines and Penalties

Claims related to fines, penalties, or punitive damages are not covered

Insolvency

Claims arising from the insolvency or bankruptcy of the insured are not covered

Product Recall Costs

Costs incurred in recalling products are not covered unless you have opted for the cover

Repair Costs

Costs incurred in repairing defective products are not covered

Aircraft Products

Any product used as part of an aircraft is not covered

Note

Please read policy wording for detailed exclusions

Benefits You Deserve

Why Bajaj Allianz?

view allDownload Policy Document

Get instant access to your policy details with a single click.

Trusted Risk Advisor

Mobile Self Risk Assessment

PRIME Inspection app helps to evaluate quality of your property (Shop, Office, Plant or Others) having SI upto INR 50 crs. It is simple to navigate having multiple Q & A designed for client

Instant Generation of Risk Report

It helps Provide Risk Recommendations, Risk Quality Rating (RQR), Peer Comparison & GAP Analysis for the client

Frequently Bought Together

View AllStep-by-Step Guide

To help you navigate your insurance journey

How to Buy

-

0

Visit the Bajaj Allianz General Insurance website

-

1

Fill in the lead generation form with accurate details

-

2

Get quote, make payment and receive the policy documents

How to Renew

-

0

Contact the Policy Issuing Office

-

1

Review expiring policy and share necessary details

-

2

Receive renewal quote

-

3

Make renewal payment

-

4

Receive the renewed policy documents via email

How to Claim

-

0

Contact us through our customer service touchpoints

-

1

Submit the claim form along with the necessary documents

-

2

Provide details of the incident and any supporting evidence

-

3

Cooperate with the claims investigation process

-

4

Receive the claim settlement as per the policy terms

Know More

-

0

For any further queries, please reach out to us

-

1

Phone +91 020 66026666

-

2

Fax +91 020 66026667

Quick Links

Diverse more policies for different needs

Insurance Samjho

Critical Illness Insurance

Health Claim by Direct Click

Personal Accident policy

Global Personal Guard Policy

Claim Motor On The Spot

Two-Wheeler Long Term Policy

24x7 Roadside/Spot assistance

.webp)

Caringly Yours (Motor Insurance)

Travel Insurance Claim

Cashless Claim

24x7 Missed Facility

Filing a Travel Insurance Claim

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

Explore our articles

View all

Create a Profile With Us to Unlock New Benefits

- Customised plans that grow with you

- Proactive coverage for future milestones

- Expert advice tailored to your profile

What Our Customers Say

Comprehensive Coverage

I run a small manufacturing unit in Mumbai, and bajaj allianz’s commercial general liability insurance has been a lifesaver. The policy is extensive and gives me peace of mind.

Varun Jesth

Mumbai

29th Feb 2024

Affordable Premiums

I was worried about the cost of liability insurance, but Bajaj Allianz offers reasonable premiums.

Anamika Das

Kolkata

10th Dec 2024

Easy Online Purchase

I purchased my General Liability Insurance online within minutes. The website was user-friendly, and I received my policy documents immediately.

Darsheel Batra

Bangalore

11th Dec 2024

Quick Claim Settlement

I had to file a claim due to an accident at my restaurant. Bajaj Allianz processed my claim quickly and without unnecessary paperwork. Highly recommend their efficient service.

Nupoor Nair

Mumbai

16th Jan 2024

Excellent Customer Support

The customer service team was very helpful in explaining the liability coverage options. I run a pharmacy, and they guided me in choosing the right plan for me.

Amar Anand

Hyderabad

19th Oct 2024

FAQ's

The CGL policy usually provides coverage for businesses against legal liabilities arising from bodily injury, property damage, personal and advertising injury, and more.

Protecting businesses from financial losses due to legal liabilities arising from their operations, products, or services is the purpose of the CGL policy. Investing in this policy ensures businesses can help you manage risks effectively.

Key features of CGL policy may include coverage for bodily injury and property damage liability, personal and advertising injury, medical payments, products-completed operations, and legal defense costs.

Businesses of all sizes and industries can benefit from the CGL policy by securing businesses against potential legal liabilities and associated costs.

For detailed information, including specific terms, conditions, and how to apply, visit the website or contact your insurance provider customer service directly.

The policy usually covers legal liabilities arising from bodily injury or property damage to third parties, personal and advertising injury, medical payments, and products-completed operation

Yes, the policy is usually customisable to meet the specific needs of different businesses, including coverage limits and additional endorsements. Check with your insurance provider to know more.

Yes, the policy usually covers the cost of legal defense in the event of a lawsuit, even if the claims are groundless.

The policy typically covers medical expenses for injuries sustained by third parties on your business premises, regardless of fault, providing immediate financial assistance.

Yes, common exclusions include intentional misconduct, contractual liabilities, and certain professional services. Always review your policy for specific exclusions.

In the event of a claim, notify your insurance provider immediately. Provide necessary documents such as the insurance policy, incident report, and any relevant legal documents. The insurer will assess the claim and process it accordingly.

Commonly required documents include the insurance policy, incident report, legal notices, medical reports, and any other relevant documentation.

The time frame can vary depending on the complexity of the claim and the completeness of the documentation provided. Prompt reporting and submission of all required documents can expedite the process.

If your claim is denied, review the reasons provided by your insurance provider. You can appeal the decision by providing additional evidence or documentation to support your claim.

Yes, common exclusions usually include intentional misconduct, contractual liabilities, and certain professional services. Always review your policy for specific exclusions.

In case of renewal, contact your insurance provider before the policy expiration date to discuss renewal options. Review your coverage needs and make any necessary adjustments to the polic

Yes, you can update your policy to reflect any changes in your business operations, such as new services, products, or additional coverage needs.

Consider changes in your business operations, potential new risks, and any past claims. Adjust coverage limits and endorsements as needed.

Some insurers may offer a grace period, but it’s important to renew your policy before it expires to avoid any gaps in coverage.

No, you cannot switch your insurer, but in case you want anything to be changed or improvised you may reach out to your insurance provider.

Secure your future with the right insurance.

Download Caringly your's app!