Suggested

-

health insurance

-

group personal accident

-

bike insurance

-

car insurance

-

cat insurance

-

check car details

-

health insurance plans

-

health cover plans

-

two wheeler insurance

-

2 wheeler insurance

-

renewal of car insurance

-

renew car insurance

-

car insurance renewal

-

car insurance renew

-

car insurance online

-

maruti suzuki car insurance

-

maruti suzuki insurance

-

maruti insurance

-

travel insurance

-

car no details

-

car number details

-

health insurance plans for family

-

medical insurance plans for family

-

best health insurance in india

-

good health insurance in india

Commercial Insurance

Marine Open Policy Inland Transit Insurance

Key Features

Cargo Security for Seamless Operations

Coverage Highlights

Marine Inland policy covers all transportation needs within a specific area

Helps your business run smoothly

Offers a range of features tailored to meet the diverse needs of businesses engaged in the transportation of goods

Flexibility

Adjust coverage as your needs change, ensuring your goods are shielded from theft, damage, or loss

Continuous Protection

Your goods stay safe during travel within a specific area without needing separate policies for each shipment, saving you time and hassle

Affordable Rates

Enjoy competitive prices and flexible payment options, helping you manage costs while still getting the coverage you need

Inclusions

What's covered?

Loss or Damage During Transit

Protection against loss or damage to goods while they are being transported by road, rail, or inland waterway

Theft and Pilferage

Coverage for theft or pilferage of goods during transit

Accidental Damage

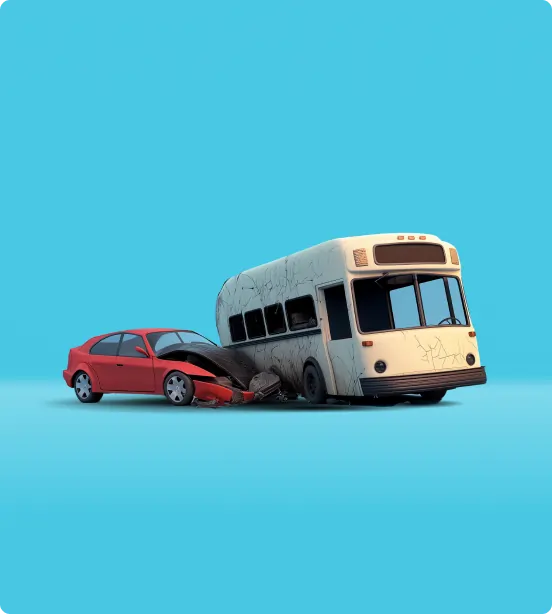

Protection against accidental damage caused by collisions, overturning, or derailment of the transporting vehicle

Natural Disasters

Coverage for damage caused by natural disasters such as floods, earthquakes, and storms

Fire and Explosion

Protection against loss or damage due to fire or explosion during transit

Temporary Storage

Coverage for goods stored temporarily at intermediary locations during the transit process

Note

Please read policy wording for detailed inclusions

Exclusions

What's not covered?

Insufficiency in Packing

Damages due to inadequate packing

Inherent Vice

Loss, damage, or expense caused by inherent vice or nature of the insured subject-matter

Wear & Tear, Leakage

Ordinary leakage, loss in weight or volume, or wear and tear of insured subject-matter

War & Nuclear Risk

Loss, damage, or expense from use of atomic or nuclear weapons or radioactive force

Note

Please read policy wording for detailed exclusions

Benefits You Deserve

Download Policy Document

Get instant access to your policy details with a single click.

Trusted Risk Advisor

Mobile Self Risk Assessment

PRIME Inspection app helps to evaluate quality of your property (Shop, Office, Plant or Others) having SI upto INR 50 crs. It is simple to navigate having multiple Q & A designed for client

Instant Generation of Risk Report

It helps Provide Risk Recommendations, Risk Quality Rating (RQR), Peer Comparison & GAP Analysis for the client

Frequently Bought Together

View AllStep-by-Step Guide

To help you navigate your insurance journey

How to Buy

-

0

Visit the Bajaj Allianz General Insurance website

-

1

Fill in the lead generation form with accurate details

-

2

Get quote, make payment and receive the policy documents

How to Renew

-

0

Contact the Policy Issuing Office

-

1

Review expiring policy and share necessary details

-

2

Receive renewal quote

-

3

Make renewal payment

-

4

Receive the renewed policy documents via email

How to Claim

-

0

Contact us through our customer service touchpoints

-

1

Submit the claim form along with the necessary documents

-

2

Provide details of the incident and any supporting evidence

-

3

Cooperate with the claims investigation process

-

4

Receive the claim settlement as per the policy terms

Know More

-

0

For any further queries, please reach out to us

-

1

Phone +91 020 66026666

-

2

Fax +91 020 66026667

Quick Links

Diverse more policies for different needs

Insurance Samjho

Critical Illness Insurance

Health Claim by Direct Click

Personal Accident policy

Global Personal Guard Policy

Claim Motor On The Spot

Two-Wheeler Long Term Policy

24x7 Roadside/Spot assistance

.webp)

Caringly Yours (Motor Insurance)

Travel Insurance Claim

Cashless Claim

24x7 Missed Facility

Filing a Travel Insurance Claim

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

Explore our articles

View all

Create a Profile With Us to Unlock New Benefits

- Customised plans that grow with you

- Proactive coverage for future milestones

- Expert advice tailored to your profile

What Our Customers Say

Hassle-Free Marine Insurance Purchase

Getting my Marine Transit Insurance from Bajaj Allianz was a smooth experience. The online process was straightforward, and I received my policy instantly without any complications.

Vikram Mehta

Maharashtra

25th Feb 2025

Fast & Efficient Claim Settlement

When my shipment was damaged during transit, Bajaj Allianz processed my claim quickly. The support team was professional and guided me throughout, making the process stress-free. Excellent service!

Ravi Sharma

Gujarat

18th Jan 2025

Comprehensive Coverage for My Business

Bajaj Allianz Marine Insurance provides extensive coverage against various transit risks. I feel secure knowing my goods are protected, whether transported by road, air, or sea. Excellent policy!

Priya Nair

Kerala

5th Jan 2025

Reliable Customer Support

I had queries about my Marine Insurance policy, and the Bajaj Allianz support team was extremely helpful. They clarified all the details and provided step-by-step assistance with my claim.

Amit Verma

Rajasthan

28th Dec 2024

Affordable & Customisable Plans

Bajaj Allianz offers the best Marine Insurance at competitive rates. Their flexible coverage options allowed me to customise my policy as per my business needs. Great value for money!

Neha Singh

Karnataka

12th Dec 2025

Transparent and Detailed Policy Documentation

The policy documentation was clear and concise, providing a detailed breakdown of coverage and exclusions. This transparency gave us confidence in our insurance coverage.

Suresh Gupta

Ahmedabad

15th Oct 2023

Competitive Rates for Extensive Coverage

We compared rates from several insurance providers, and this company offered the most competitive premiums for the level of coverage we required. We are satisfied with the value we receive.

Kavita Desai

Surat

28th Sep 2023

FAQ's

Marine insurance provides coverage for loss or damage to ships, cargo, terminals, and any transport by which property is transferred, acquired, or held between points of origin and final destination.

Marine insurance is designed to protect businesses and individuals from financial losses associated with maritime activities. It covers risks such as damage to ships, loss of cargo, and liabilities arising from maritime operations. This ensures that stakeholders can recover financially from unforeseen events during transit by sea, air, or land.

Coverage usually includes risks such as theft, piracy, fire, explosion, natural disasters, and accidents during transit. Specific coverage details can vary based on the policy.

Ideal for occasional shippers, small to medium-sized businesses, and individuals who do not ship goods regularly, Single Transit Policy is suitable for high-value cargo shipments, such as electronics, artwork, or luxury products.

This policy is ideal for businesses that frequently ship goods, as it offers comprehensive coverage for all shipments made within the policy period. It is usually beneficial for companies involved in international trade.

A marine open policy provides continuous coverage for multiple shipments over a specified period, usually a year, whereas a single transit policy covers a single shipment from one location to another. Typically, a marine open policy is more suitable for businesses with frequent shipping needs.

Yes; marine single transit policies is usually tailored to meet the specific requirements of the business or individual. This may include customising coverage based on the nature of the goods and the mode of transportation.

Yes, high-value items can be included in a marine open policy. However, it is important to declare these items and ensure that the policy limits and coverage are adequate to protect their value.

Premiums are typically based on factors such as the value of the cargo, the type of goods, the route, the mode of transport, and the duration of the voyage.

Yes, policies can often be tailored to meet the specific needs of the business, including coverage for specific routes, types of cargo, and additional risks.

In the event of a loss or damage, notify your insurer immediately. Provide necessary documents such as the bill of lading, insurance policy, and damage report. The insurer will assess the claim and process it accordingly.

Commonly required documents include the insurance policy, bill of lading, commercial invoice, packing list, survey report, and any other relevant documentation.

The time frame can vary depending on the complexity of the claim and the completeness of the documentation provided. Prompt reporting and submission of all required documents can expedite the process.

If your claim is denied, review the reasons provided by the insurer. You can appeal the decision by providing additional evidence or documentation to support your claim.

Yes, common exclusions include losses due to improper packaging, inherent defects in the goods, war, strikes, and intentional misconduct. Always review your policy for specific exclusions.

Contact your insurer before the policy expiration date to discuss renewal options. Review your coverage needs and make any necessary adjustments to the policy.

Yes, you can update your policy to reflect any changes in your business operations, such as new routes, types of cargo, or additional coverage needs.

Consider changes in your shipping routes, types of cargo, and any new risks that may have emerged. Review your past claims and adjust coverage limits as needed.

Some insurers may offer a grace period, but it’s important to renew your policy before it expires to avoid any gaps in coverage.

Yes, you can compare policies from different insurers and switch if you find a better option. Ensure there is no lapse in coverage during the transition.

Why juggle policies when one app can do it all?

Download Caringly your's app!

What is Open Policy Inland Transit Insurance and Its Benefits

Open Policy Inland Transit Insurance is like a one-stop solution for businesses that regularly move goods from one place to another. Instead of getting separate insurance for each shipment, this policy covers all your transportation needs in a specific area. It keeps your goods safe from things like theft, damage, or loss while they're on the move. This insurance gives you peace of mind and helps your business run smoothly by protecting your cargo all the time. By choosing Open Policy Inland Transit Insurance, you can make your logistics simpler and avoid financial worries related to transporting goods.

Importance of Open Policy Inland Transit Insurance

Open Policy Inland Transit Insurance offers a range of features tailored to meet the diverse needs of businesses engaged in the transportation of goods. Major ones are listed below:

Continuous Protection

Your goods stay safe during travel within a specific area without needing separate policies for each shipment, saving you time and hassle.

Flexibility:

Adjust coverage as your needs change, ensuring your goods are shielded from theft, damage, or loss.

Complete Security:

Your goods are covered during travel and handling along the entire journey, guarding against unexpected events and providing financial security.

Extra Benefits:

Get added services like risk assessment, inspections, and help with claims, making sure your goods are protected and your risks are minimized.

Affordable Rates:

Enjoy competitive prices and flexible payment options, helping you manage costs while still getting the coverage you need.

Easy Procedures:

Simplified insurance processes make things smoother for businesses in transportation, giving you peace of mind and saving time.

Personalized Solutions:

Tailored features to fit your specific needs, ensuring your goods are protected and your business runs smoothly.

Coverage of Marine Open Policy Inland Transit Insurance

Bajaj Allianz General Insurance Company (BAGIC) offers comprehensive coverage with its Open Policy Inland Transit Insurance.

● Coverage extends to goods during transit within a specified geographical area, guarding against theft, damage, or loss.

● The policy also covers and handling at various points along the transportation route, ensuring comprehensive protection throughout the process.

● BAGIC provides value-added services like risk assessment and loss prevention measures to minimize risks and losses for businesses.

Exclusions of Marine Open Policy Inland Transit Insurance

Exclusions under BAGIC's Open Policy Inland Transit Insurance encompass various scenarios to safeguard against potential risks and losses, including:

● Damages due to inadequate packing

● Inherent vice or nature of the goods

● Delay and wear and tear

● Losses during war and nuclear risks

● Frauds or dishonest acts are excluded

ELIGIBILITY

For businesses transporting goods within a designated area, our policy offers tailored coverage and protection. Major ones are listed below:

● Businesses engaged in transporting goods within a specified geographical area are eligible.

● The policy caters to various industries and businesses involved in goods movement.

● It provides comprehensive coverage and protection for goods in transit.

● Tailored to meet the specific needs of businesses transporting goods.

● Offers coverage for a wide range of risks associated with goods transportation.

MARINE OPEN POLICY INLAND TRANSIT INSURANCE CLAIM PROCESS

Follow these steps to lodge a claim under marine insurance policy:

Step 1:Notify the Insurer Immediately: Report any loss promptly to the insurer.

Step 2:The insurer provides a claim reference number and surveyor details if appointed, or/and Letter of Requirement (LOR) is issued for further claim processing.

Step 3:Submission of Documents: Submit necessary claim-related documents as per the LOR.

Step 4:Documents Verification: The surveyor/insurer examines the submitted documents and informs about any pending requirements. Upon verification, if all documents are satisfactory, the insurer/surveyor assesses the reported claim based on marine insurance policy terms and conditions.

Step 5:Claim Approval: Upon assessing the loss, the insurer seeks consent from the insured and requests NEFT details for payment processing, along with any additional documents, if required.

Step 6: Claim Settlement: Once the insurer transfers the claim payment via NEFT, it reflects in the insured's account within 3-4 working days.

DOCUMENTS REQUIRED TO FILE CLAIM

After a successful claim filing, the insurer provides URN number/claim number for document upload and status tracking. The necessary documents are as follows:

● Marine Insurance Policy Copy

● Invoice Copy

● Transit Document (Lorry Receipts/Good Receipts/Consignment Notes/Rail Receipts/ Bill of Lading / Airway bill copy)

● Packing List

● Insured’s Claim bill

● Damage Photos (in case of damage to the cargo)

● Copy of Monetary Claim lodged on carrier

CONCLUSION

In conclusion, BAGIC's Marine Open Policy Inland Transit offers comprehensive protection for goods in transit, catering to diverse industries and businesses. With coverage extending across various risks such as inadequate packing, inherent vice, and delays, we ensure peace of mind for our clients. Our flexible options and value-added services enhance the risk management strategy, providing reliable support and assistance. Trust in our expertise and experience to safeguard your goods and streamline your transportation operations. BAGIC remains committed to delivering exceptional service and tailored solutions, ensuring the utmost satisfaction and security for our valued clients.