Suggested

-

health insurance

-

group personal accident

-

bike insurance

-

car insurance

-

cat insurance

-

check car details

-

health insurance plans

-

health cover plans

-

two wheeler insurance

-

2 wheeler insurance

-

renewal of car insurance

-

renew car insurance

-

car insurance renewal

-

car insurance renew

-

car insurance online

-

maruti suzuki car insurance

-

maruti suzuki insurance

-

maruti insurance

-

travel insurance

-

car no details

-

car number details

-

health insurance plans for family

-

medical insurance plans for family

-

best health insurance in india

-

good health insurance in india

Commercial Insurance

Office Package Insurance

Key Features

Your all-in-one shield against office risks

Coverage Highlights

Get comprehensive coverage for your office

Suitable for

All types of office premises

Assets covered

Structure & building, Electrical & electronic equipments, furniture fixtures & fittings

All-Round Protection for Your Office

Safeguard your office against fire, explosion or implosion, natural calamities, terrorism, riots, strikes, malicious damage and more with a policy designed to keep your office running smoothly

Customizable Plans

Flexibility to choose coverage options that best suit the specific needs of your office

Inclusions

What’s covered?

Fire and Allied Perils

Covers damages due to fire, lightning, explosion, aircraft damage, riot, strike, malicious damage, storm, cyclone, typhoon, tempest, hurricane, tornado, flood, and inundation

Burglary and Theft

Covers loss or damage to property and contents due to burglary or theft, including break-in attempts

Personal Accident Insurance

Covers accidental death, permanent total disability, permanent partial disability, and temporary total disability of employees

Employee Compensation

Covers legal liability of the employer for accidental injury to employees during their work

Money Insurance

Covers loss of money due to theft, robbery, or burglary while in transit or stored in a locked safe within the office premises

Public Liability

Covers third-party legal liability arising out of accidental bodily injury or property damage occurring within the office premises

Electronic Equipment Insurance

Covers accidental damage, breakdown, and theft of computers, servers, and other electronic equipment used in the office

Plate Glass Insurance

Covers accidental breakage of fixed glass fittings, including display windows and partitions within the office

Note

Please read policy wording for detailed inclusions

Exclusions

What’s not covered?

Normal wear & tear

Regular maintenance and wear-and-tear damages

War and Nuclear Risks

Losses due to war & nuclear hazards

Deliberate Acts

Losses from deliberate acts by the insured or representatives

Property Removed from Premises

Excludes losses incurred due to removal of property unless under specific circumstances

Excess

Deductible or Excess as mentioned in policy schedule

Note

Please read policy wording for detailed exclusions

Additional Covers

What else can you get?

Accidental Damage Cover

Covers accidental damage to property or contents, like spills or breaks

Electrical / Electronic Appliance Clause Cover

Covers damage to appliances from electrical faults or power surges

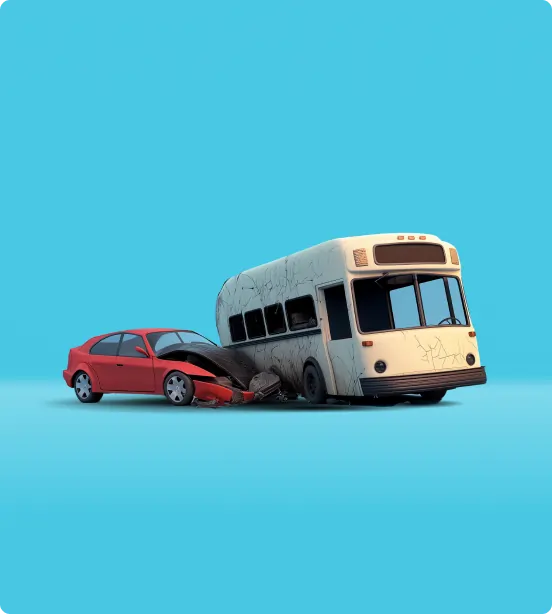

Impact Damage Cover

Covers damage from physical impacts, like a car or tree hitting your property

Snow Damage Cover

Covers damage from snow, like roof collapse or falling ice

Minor Works

Small, quick, and inexpensive construction or renovation projects

Escalation Clause

Allows contract price increase if material or labor costs rise

Waiver of Involuntary Improvement

Protects against paying for unauthorized property improvements

Immediate Repairs

Insured may immediately begin repairs or reconstruction work of the insured property so that the normal operations return back to normal

More

Many more add-ons options available

Benefits You Deserve

Why Insure Your Commercial Assets with Bajaj Allianz?

view allDownload Policy Document

Get instant access to your policy details with a single click.

Trusted Risk Advisor

Mobile Self Risk Assessment

PRIME Inspection app helps to evaluate quality of your property (Shop, Office, Plant or Others) having SI upto INR 50 crs. It is simple to navigate having multiple Q & A designed for client

Instant Generation of Risk Report

It helps Provide Risk Recommendations, Risk Quality Rating (RQR), Peer Comparison & GAP Analysis for the client

Frequently Bought Together

View AllStep-by-Step Guide

To help you navigate your insurance journey

How to Buy

-

0

Visit the Bajaj Allianz General Insurance website

-

1

Fill in the lead generation form with accurate details

-

2

Get quote, make payment and receive the policy documents

How to Renew

-

0

Contact the Policy Issuing Office

-

1

Review expiring policy and share necessary details

-

2

Receive renewal quote

-

3

Make renewal payment

-

4

Receive the renewed policy documents via email

How to Claim

-

0

Contact us through our customer service touchpoints

-

1

Submit the claim form along with the necessary documents

-

2

Provide details of the incident and any supporting evidence

-

3

Cooperate with the claims investigation process

-

4

Receive the claim settlement as per the policy terms

Know More

-

0

For any further queries, please reach out to us

-

1

Phone +91 020 66026666

-

2

Fax +91 020 66026667

Quick Links

Diverse more policies for different needs

Insurance Samjho

Critical Illness Insurance

Health Claim by Direct Click

Personal Accident policy

Global Personal Guard Policy

Claim Motor On The Spot

Two-Wheeler Long Term Policy

24x7 Roadside/Spot assistance

.webp)

Caringly Yours (Motor Insurance)

Travel Insurance Claim

Cashless Claim

24x7 Missed Facility

Filing a Travel Insurance Claim

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

Explore our articles

View all

Create a Profile With Us to Unlock New Benefits

- Customised plans that grow with you

- Proactive coverage for future milestones

- Expert advice tailored to your profile

What Our Customers Say

Business Eligibility

The policy caters to businesses, from small shops to large commercial establishments. Coverage is designed to protect property, stock, and essential business assets.

Raj Kapoor

Gujarat

22nd Dec 2024

Coverage Benefits

The policy provides coverage against fire, burglary, natural disasters, and accidental damage. It ensures complete protection for business premises and assets, giving peace of mind to business owners.

Meena Sharma

New Delhi

10th Jan 2025

Buying Bajaj Allianz Commercial Property Insurance

Buying my Commercial Property Insurance from Bajaj Allianz was effortless. The process was clear, quick, and hassle-free. I received my policy instantly, ensuring my business is well-protected.

Rajesh Malhotra

Andhra Pradesh

5th Feb 2025

Customisation and Add-Ons

The policy offers various add-ons like loss of rent cover, debris removal, and architect fees, providing enhanced protection tailored to your business needs.

Rohit Mehta

Uttar Pradesh

5th Oct 2024

Claim Settlement Process

Bajaj Allianz ensures a quick and transparent claims process. With proper documentation, claims are processed efficiently, minimising business downtime.

Anjali Verma

Rajasthan

15th Nov 2024

FAQ's

An Office Package Insurance Policy is a comprehensive insurance solution designed to cover various risks associated with running an office. It integrates multiple coverages, such as property damage, liability and coverage for employees into a single policy

This policy provides financial security and peace of mind by protecting your office premises, equipment, and employees against unforeseen events like fire, theft, natural disasters, and accidents

The policy typically covers: Property damage due to fire, natural disasters, and other perils,Burglary and theft, Employee benefits, including personal accident, insurance and Employee compensation, Third-party liability, Money, Machinery and Electronic equipment against Breakdown and theft losses

Businesses across various sectors, including law firms, accounting firms, consulting firms, IT companies, startups, Real Estate firms, Travel Agencies any other offices, and more, can benefit from this policy

Yes, customizable plans can be designed to suit the specific needs of your office.

When comparing policies, consider factors such as coverage components, exclusions, premium costs, and the reputation of the insurance provider. It's essential to choose a policy that offers comprehensive protection and aligns with your business needs

The benefits include comprehensive protection against various risks, coverage for employee accidents, and protection against third-party liabilities

Some common types include property insurance (which covers damages to physical assets), liability insurance (which protects against legal claims), marine insurance (covers goods in transit), cyber insurance (which safeguards against data breaches), and employee benefits insurance (which provides coverage for employees).

Choosing the right policy requires a detailed risk assessment of your business operations. Factors like the nature of the business, asset value, number of employees, regulatory requirements, and industry-specific risks should be considered. Consulting an insurance expert or broker can help tailor a policy.

Businesses can enhance their coverage with add-ons like business interruption insurance, professional indemnity, cyber security coverage, and extended liability protection. Customisation allows businesses to adapt their coverage to industry risks, operational requirements, and financial concerns, ensuring they remain protected.

Most commercial insurance policies are valid for one year, requiring renewal before expiry to maintain continuous protection. However, insurers also offer multi-year policies that provide long-term coverage and stability. Renewing on time ensures uninterrupted coverage and prevents financial risks due to policy lapses.

The required documents include business registration certificates, financial statements, property ownership or lease documents, employee details, and risk assessment reports. For specialised policies like marine or cyber insurance, additional documentation may be required. Ensuring all necessary documents are submitted correctly helps speed up the

First, the business must immediately notify the insurer about the incident. Next, necessary documents such as claim forms, invoices, FIR reports (if applicable), and evidence of loss must be submitted. The insurer will then conduct an assessment or survey to verify the claim before disbursing the approved amount.

Simple claims like minor property damage may be settled within a few weeks, while larger claims involving legal or financial reviews may take months. Insurers prioritise efficient settlements, but delays can occur due to incomplete documentation, third-party verifications, or policy exclusions.

Claims can be rejected due to various reasons, such as policy exclusions, late claim submission, incorrect or incomplete documentation, misrepresentation of facts, or failure to meet policy terms. For example, if a business fails to implement safety measures required by the policy, the insurer may deny the claim.

Yes, if a claim is denied, businesses can file an appeal with the insurer by submitting additional supporting documents or explanations. If the issue remains unresolved, businesses can escalate it through the insurer’s grievance redressal mechanism or approach the Insurance Ombudsman for further review.

Many commercial insurance policies provide coverage for fire, floods, earthquakes, and other natural disasters. Some businesses may need to purchase additional disaster coverage if their location is prone to specific risks. It is important to check the policy’s exclusions and coverage limits to ensure adequate protection.

It is recommended to renew a commercial insurance policy at least 30 days before its expiry to ensure uninterrupted coverage. A lapse in policy renewal can expose businesses to financial risks, legal liabilities, and potential penalties. Early renewal also gives businesses time to review coverage and compare policies

Yes, businesses can adjust their coverage, increase or decrease the sum insured, add or remove riders, or switch to a different plan during renewal. It is essential to reassess business risks, asset value, and operational changes before making modifications. Consulting an insurance provider helps in choosing the best-suited coverage options.

If a commercial insurance policy is not renewed on time, it lapses, leaving the business without coverage. This means any damages, legal claims, or financial losses occurring after policy expiry will not be covered. Some insurers offer a grace period for renewal, but once it expires, businesses may have to apply for a new policy.

Premiums can increase or decrease during renewal based on various factors, including previous claims history, business risk exposure, policy updates, and changes in industry regulations. Implementing safety measures, maintaining a good claims record, and choosing optimal coverage can help businesses negotiate lower premiums.

Yes, opting for a multi-year renewal provides several advantages, such as locked-in premiums, discounts, and continuous coverage without the hassle of annual renewals. Some insurers offer long-term policies with reduced rates, helping businesses save on costs while ensuring uninterrupted protection.

Secure your future with the right insurance.

Download Caringly your's app!