Suggested

-

health insurance

-

group personal accident

-

bike insurance

-

car insurance

-

cat insurance

-

check car details

-

health insurance plans

-

health cover plans

-

two wheeler insurance

-

2 wheeler insurance

-

renewal of car insurance

-

renew car insurance

-

car insurance renewal

-

car insurance renew

-

car insurance online

-

maruti suzuki car insurance

-

maruti suzuki insurance

-

maruti insurance

-

travel insurance

-

car no details

-

car number details

-

health insurance plans for family

-

medical insurance plans for family

-

best health insurance in india

-

good health insurance in india

My Active Policy

Discover Our Insurance Offerings

Health Insurance

Health

Car Insurance

Car

Bike Insurance

Bike

Climatesafe Insurance

Climatesafe

Travel Insurance

Travel

Home Insurance

Home

EV Insurance

EV

Pet Insurance

Pet

Cyber Insurance

Cyber

Find the Best Health Insurance

Secure Your Everyday at Every Step of the Way

Find the Best Car Insurance

Secure Your Everyday at Every Step of the Way

Find the Best Bike Insurance

Secure Your Everyday at Every Step of the Way

Stay Weather-Proof with Climatesafe

Protect your business from any climate change risks

Find the Best Travel Insurance

Secure Your Everyday at Every Step of the Way

Find the Best Home Insurance

Secure Your Everyday at Every Step of the Way

Find the Best EV Insurance

Secure Your Everyday at Every Step of the Way

Find the Best Cyber Insurance

Secure Your Everyday at Every Step of the Way

Employee Insurance

Employee

Transit Insurance

Transit

Property Insurance

Property

Liability Insurance

Liability

Engineering Insurance

Engineering

Find the Best Employee Insurance

From Risk to Resilience–We've got You Covered

Find the Best Transit Insurance

From Risk to Resilience–We've got You Covered

Find the Best Property Insurance

From Risk to Resilience–We've got You Covered

Find the Best Liability Insurance

From Risk to Resilience–We've got You Covered

Find the Best Engineering Insurance

From Risk to Resilience–We've got You Covered

Fire Insurance

Fire

Marine Insurance

Marine

Shop Insurance

Shop

Engineering Insurance

Engineering

Liability Insurance

Liability

Miscellaneous Insurance

Miscellaneous

Claim Registration

Claim Reg.

Renew Policy

Renew

Find the Best Fire Insurance

Shielding Your Dreams, Empowering Your Success

Find the Best Marine Insurance

Shielding Your Dreams, Empowering Your Success

Find the Best Shop Insurance

Shielding Your Dreams, Empowering Your Success

Find the Best Engineering Insurance

Shielding Your Dreams, Empowering Your Success

Find the Best Liability Insurance

Shielding Your Dreams, Empowering Your Success

Find the Best Miscellaneous Insurance

Shielding Your Dreams, Empowering Your Success

Find the Best Claim Registration

Shielding Your Dreams, Empowering Your Success

Find the Best Renew Policy

Shielding Your Dreams, Empowering Your Success

Pradhan Mantri Jan Arogya Yojana

PMJAY

Pradhan Mantri Suraksha Bima Yojana

PMSBY

PMFBY

PMFBY

Weather Insurance

Weather

Pradhan Mantri Jan Arogya Yojana

Inclusive Insurance for a Stronger Tomorrow

Pradhan Mantri Suraksha Bima Yojana

Inclusive Insurance for a Stronger Tomorrow

Pradhan Mantri Fasal Bima Yojana

Inclusive Insurance for a Stronger Tomorrow

Find the Best Weather Insurance

Inclusive Insurance for a Stronger Tomorrow

Family

Senior Citizens

Women

Farmers

Entrepreneurs

Youth

#ForwardKaroCare

Trusted by 14 Crore+ customers!

Insurance for All!

Why Choose Us?

View allMotor Insurance

Ensuring Miles of Smiles

EV Insurance for All!

Drive Green, Insure Smart!

Health Insurance

Complete coverage starting ₹15/day*

Motor & Health Companion

Drive Confidently with Bajaj Allianz

Experience seamless vehicle management with the Bajaj Allianz Drive Smart App, featuring on-road assistance, fuel efficiency stats, driving alerts, and more

Track, Manage & Thrive with Your All-In-One Health Companion

Discover a health plan tailored just for you–get insights and achieve your wellness goals

Take Charge of Your Health & Earn Rewards–Start Today!

Be proactive about your health–set goals, track progress, and get discounts!

24/7 Assistance

Get the assistance you need for all your insurance queries. We're here to help!

Insurance Samjho

Critical Illness Insurance

Health Claim by Direct Click

Personal Accident policy

Global Personal Guard Policy

Claim Motor On The Spot

Two-Wheeler Long Term Policy

24x7 Roadside/Spot assistance

.webp)

Caringly Yours (Motor Insurance)

Travel Insurance Claim

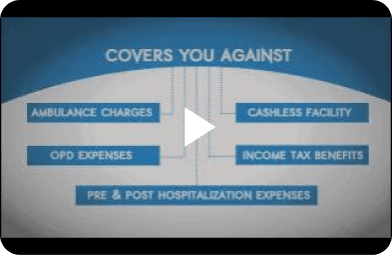

Cashless Claim

24x7 Missed Facility

Filing a Travel Insurance Claim

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

#FaaydeKiBaat #HealthInsurance

Health Insurance

Apno Ke Liye Care | A Father's Day Special

Motor On the Spot(Hindi)

#bikeinsurance Bajaj Allianz Two-wheeler Insurance

Discount difference (Hindi)

Cashless Benefits Overseas (Hindi )

यात्रा बीमा दावा दाखिल कैसे करें? || इनश्योरेंस की पाठशाला(HINDI)

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

Insurance Simplified: Must-Read Articles

View allTravel Insurance

Worldwide cover starting ₹13/day*

Pet Protection Plan

Secure Their Paw-someness with Plans Starting From ₹ 169*

Home Insurance

Protecting Your Home–Every Brick, Every Memory

Commercial Insurance

Safety Net for Your Business Venture

Create a Profile With Us to Unlock New Benefits

- Customised plans that grow with you

- Proactive coverage for future milestones

- Expert advice tailored to your profile

Leadership Insights

Dr. Tapan Singhel - MD & CEO

Our mission is to bring peace of mind through reliable, innovative insurance solutions.

Know MoreInsurance Insights: Watch & Learn

Understand How You Can Claim Car Insurance Claims

Monsoon Tips to Prevent Accidents & Use of OTS

Car Care Tips for Monsoon

DriveSmart | A Vehicle Tracking System by Bajaj Allianz

Benefits of Travel Insurance at Bajaj Allianz

Do’s that you must remember while travelling

What to do when you fall sick when you’re abroad

How to Register a Lost Baggage Claim with Bajaj Allianz

Safety Tips for Monsoon

Home Insurance #WhackTheHack

Home Insurance Claim Process

What’s a Homeowner’s Biggest Fear?

Tips to Stay Healthy for the Rainy Season

Health Prime Rider–A Rider for all Health Care Product

Importance of Health Insurance

Step-by-Step Guide on Health Insurance Reimbursement

Bob Svagene – The Online Stalker

Tai Tai Phish – The Phishing Expert

Buggy Bhai – Aap K Data Ka Maalik

#WhackTheHack || CyberSafe Insurance

Motor On the Spot(Hindi)

#bikeinsurance Bajaj Allianz Two-wheeler Insurance

Discount difference (Hindi)

Cashless Benefits Overseas (Hindi )

यात्रा बीमा दावा दाखिल कैसे करें? || इनश्योरेंस की पाठशाला(HINDI)

Safety Tips for Monsoon

Home Insurance #WhackTheHack

Home Insurance Claim Process

What’s a Homeowner’s Biggest Fear?

#FaaydeKiBaat #HealthInsurance

Health Insurance

Apno Ke Liye Care | A Father's Day Special

Bob Svagene – The Online Stalker

Tai Tai Phish – The Phishing Expert

Buggy Bhai – Aap K Data Ka Maalik

What Our Customers Say

Customer Support

This was an awesome experience with customer service while buying new bike insurance with Bajaj Allianz. Thank you!

Susheel Soni

Pune

4.5

3rd Feb 2025

Smooth Process

The two-wheeler insurance process was simple and easy. Keep up the good work!

Vinay Kathuria

Jaipur

5

1st Feb 2025

Instant Renewal

It was indeed very easy to renew my two-wheeler policy. I got it done in just 3 minutes. Thanks!

S Bala Ji

Chennai

4.5

15th Jan 2025

Smooth Experience

Bajaj Allianz is a very helpful and knowledgeable site for bike insurance.

Amit Kaduskar

Aurangabad

5

2nd Jan 2025

Prompt Assistance

Thank you so much, Bajaj Allianz, for your quick and responsive action towards my claim process. I am shocked that my claim amount has been credited so quickly. I really appreciate the smooth and swift

Vikram Singh

Delhi

4.6

12th Feb 2025

Claim Support

Super fast claim settlement! I initiated a claim for my car windscreen, which was broken due to a tree fall today, and it was settled within one hour. I appreciate the efforts of Omkar

Deepak Bhanushali

Mumbai

4.5

2nd Feb 2025

Quick Assistance

Thank you for helping me with just one tweet. You guys are really awesome. This is the fourth year I am continuing with you for car insurance. Keep it up!

Naveen Tyagi

Mumbai

4.5

8th Jan 2025

Claim Support

I really appreciate the way I was treated concerning my claim. The customer service was both professional and friendly, which enhanced my confidence in Bajaj Allianz

Pramod Chand Lakra

Jaipur

5

26th Dec 2024

Cashless Claims

Excellent service for your mediclaim cashless customers during COVID. You guys are true COVID warriors, helping patients by settling claims during these challenging times.

Arun Sekhsaria

Mumbai

4.5

8th Feb 2025

Instant Renewal

I am truly delighted by the cooperation you have extended in facilitating the renewal of my Health Care Supreme Policy. Thank you very much.

Vikram Anil Kumar

Mumbai

4.5

14th Jan 2025

Quick Claim Settlement

Good claim settlement service, even during the lockdown, has enabled me to sell the Bajaj Allianz Health Policy to more customers.

Prithbi Singh Miya

Pune

4.5

9th Dec 2024

Instant Policy Issuance

Very user-friendly. I got my policy in less than 10 minutes.

Jaykumar Rao

Bhopal

4.7

2nd Dec 2024

Simple Process

Straightforward online travel insurance quote and price. Easy to pay and buy

Madanmohan Govinda

Chennai

5

10th Feb 2025

Convenient

Very user-friendly and convenient. Appreciate the Bajaj Allianz team a lot.

Payal Nayak

Pune

4.8

6th Jan 2025

Affordable

Very nice service with an affordable premium for travel insurance.

Kinjal Boghara

Mumbai

4.5

24th Jan 2025

User Friendly

Quick, easy, and user-friendly process to buy travel insurance.

Abhijeet Doiphode

Pune

4.5

10th Dec 2024

Insightful Communication

I spoke with a Bajaj Allianz executive, and he explained everything about the home insurance, which I truly appreciate.

Prakhar Gupta

Delhi

5

18th Feb 2025

Quick Support

Bajaj Allianz, your customer service agent was courteous. He guided me throughout the transaction and was quick to respond.

Anisa Bansal

Jaipur

4.5

16th Jan 2025

Smooth Purchase

It was a good experience with the sales manager while purchasing the product.

Mahesh

Chennai

4.7

10th Dec 2024

User-friendly App

The Insurance Wallet app service is very user-friendly and provides a hassle-free process.

Kalyana Balaj

Chandigarh

4.5

2nd Mar 2019

Claim Settlement Ratio

92%

With Motor On-The-Spot, Health Direct Click, etc we provide fast claim process

Know More

Effortlessly Manage Insurance at Your Fingertips.

Download the App Now!

Caringly Yours Day at Bajaj Allianz General Insurance Branches

We are conducting Caringly Yours Day at Bajaj Allianz General Insurance Branches across India on 8-Jul-25 from 10:00 am to 4:00 pm.

If you have any queries regarding your existing insurance policy from Bajaj Allianz General Insurance, visit our branch office and we will assist you and address the queries. We firmly stand with the customers in their direst hour of need. In this journey of care, we believe in providing unique services and resolving the worries of our customers.

What makes our insurance unique

With Motor On-The-Spot, Health Direct Click, etc we provide fast claim process , Our sales toll free number:1800-209-0144