Suggested

-

health insurance

-

group personal accident

-

bike insurance

-

car insurance

-

cat insurance

-

check car details

-

health insurance plans

-

health cover plans

-

two wheeler insurance

-

2 wheeler insurance

-

renewal of car insurance

-

renew car insurance

-

car insurance renewal

-

car insurance renew

-

car insurance online

-

maruti suzuki car insurance

-

maruti suzuki insurance

-

maruti insurance

-

travel insurance

-

car no details

-

car number details

-

health insurance plans for family

-

medical insurance plans for family

-

best health insurance in india

-

good health insurance in india

Travel Insurance

Group Travel Insurance

Key Features

Travel Worry-Free, We've Got Your Back

Coverage Highlights

Bajaj Allianz General Insurance - Travel Ace International Insurance

Accident Protection

Covers accidental death and permanent disability for financial security

Trip Cancellation Safety Net

Compensates for non-refundable expenses if the trip is cancelled for covered reasons

Lost Baggage No Stress

Provides compensation for delayed or lost checked-in baggage

Emergency Medical Assistance

Covers hospitalization and medical expenses due to accidents or sudden illness

Missed Flight We’ve Got You

Covers additional expenses if you miss a connecting flight due to eligible reasons

Key Inclusions

What's covered?

Personal Accident Cover

Pays the insured amount in case of accidental death or total disability

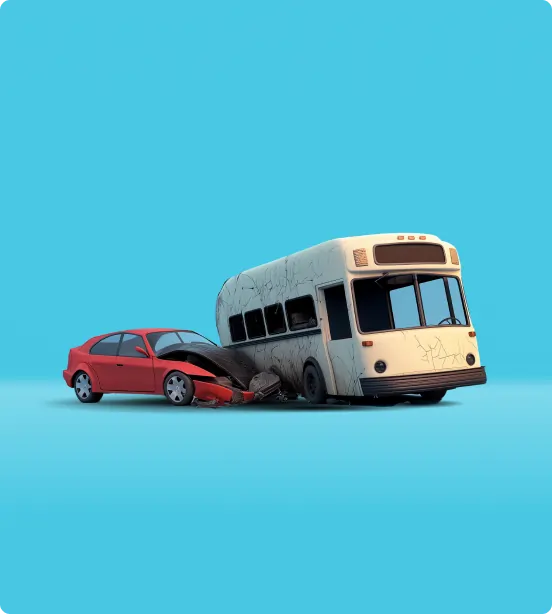

Common Carrier Accident Cover

Provides coverage for accidents occurring while traveling in public transport

Repatriation of Mortal Remains

Covers expenses for transporting remains to home or a nearby funeral facility

Emergency Medical Expenses

Pays for hospitalization, doctor consultations, and treatment for accidental injuries

Emergency Ambulance Cover

Covers expenses for road or air ambulance services for emergency medical transport

Hospital Daily Allowance

Provides a fixed daily pay-out for each day of hospitalization

Trip Cancellation and Interruption

Covers financial loss due to trip cancellation or early return for valid reasons

Missed Flight Connection

Reimburses extra costs incurred due to missing a flight connection

Key Exclusions

Exclusions

Adventure Sports Mishaps

No coverage for injuries during adventure sports unless specifically opted for

Pre-existing Medical Conditions

Does not cover treatment or complications from pre-existing illnesses

Suicide and Self-inflicted Injuries

No pay-out for intentional self-harm or suicide attempts

Alcohol and Drug Influence

Excludes claims if the insured was under the influence of alcohol or drugs

Unlicensed Driving Accidents

No coverage for accidents while driving without a valid license

War and Terrorism Risks

Losses due to war, rebellion, or terrorism are not covered

Cosmetic and Weight Loss Treatments

No reimbursement for cosmetic surgery or weight reduction programs

More Details

More Details

Reimbursement Basis

Certain covers require proof of expense and are not paid as a fixed benefit

Limited Claim Frequency

Some benefits have a restriction on the number of claims per policy period

Government Restrictions Matter

No coverage if trip cancellation occurs due to pre-declared government restrictions

Job Loss Clause

Covers involuntary job loss but excludes termination due to fraud or misconduct

Pandemic Coverage

Pandemics are excluded unless opted for under the specific pandemic cover extension

Benefits You Deserve

At-A-Glance

| Feature |

Group Travel Insurance |

|---|---|

| Coverage Type | Covers multiple travelers under one policy |

| Medical Expenses | Included for all group members |

| Trip Cancellation | Covers cancellations affecting the entire group |

| Baggage Loss & Delay | Covers baggage for all group members |

| Personal Accident Cover | Covers all travelers equally |

| Emergency Evacuation & Repatriation | Covers the entire group for medical evacuation |

| Flexibility | Can be customized for corporate, student, or leisure groups |

| Cost-Effectiveness | More cost-effective for large groups |

Download Policy Document

Get instant access to your policy details with a single click.

Why Insure Your Travel with Bajaj Allianz?

Buy NowHealth Companion

Track, Manage & Thrive with Your All-In-One Health Companion

From fitness goals to medical records, manage your entire health journey in one place–track vitals, schedule appointments, and get personalised insights

Take Charge of Your Health & Earn Rewards–Start Today!

Be proactive about your health–set goals, track progress, and get discounts!

Your Personalised Health Journey Starts Here

Discover a health plan tailored just for you–get insights and achieve your wellness goals

Your Endurance, Seamlessly Connected

Experience integrated health management with us by connecting all aspects of your health in one place

Frequently Bought Together

View AllStep-by-Step Guide

To make sure that we are always listening to our customers

How to Buy

-

0

Download the Caringly Yours Mobile App and use your login credentials

-

1

Select the travel insurance option by providing necessary details

-

2

Allow the application to process your information & get quotes

-

3

Choose the plan aligning with your travel itinerary & include add-ons

-

4

Finalise the plan selection and complete the payment process

-

5

Insurance policy & receipt will be promptly delivered to your email ID

How to Extend

-

0

Please reach out to us for policy extensions

-

1

Phone +91 020 66026666

-

2

Fax +91 020 66026667

Cashless Claim

-

0

Applicable for overseas hospitalization expenses exceeding USD 500

-

1

Submit documents online for verification.

-

2

Upon verification Payment Guarantee to be released to the hospital

-

3

Please complete necessary formalities by providing missing information

Reimbursement

-

0

On complete documentation receipt, reimbursement takes approx. 10 days

-

1

Submit original copies (paid receipts only) at BAGIC HAT

-

2

Post scrutiny, receive payment within 10 working days

-

3

Submit incomplete documents to our document recovery team in 45 days

-

4

Policy deductible will be applicable as per policy copy

Quick Links

Diverse more policies for different needs

Insurance Samjho

Critical Illness Insurance

Health Claim by Direct Click

Personal Accident policy

Global Personal Guard Policy

Claim Motor On The Spot

Two-Wheeler Long Term Policy

24x7 Roadside/Spot assistance

.webp)

Caringly Yours (Motor Insurance)

Travel Insurance Claim

Cashless Claim

24x7 Missed Facility

Filing a Travel Insurance Claim

My Home–All Risk Policy

Home Insurance Claim process

Home Insurance Simplified

Home Insurance Cover

Create a Profile With Us to Unlock New Benefits

- Customised plans that grow with you

- Proactive coverage for future milestones

- Expert advice tailored to your profile

Explore our articles

View allWhat Our Customers Say

Simple Process

Straightforward online travel insurance quote and price. Easy to pay and buy

Madanmohan Govindarajulu

Chennai

11th Apr 2019

Convenient

Very user-friendly and convenient. Appreciate the Bajaj Allianz team a lot.

Payal Nayak

Pune

15th Mar 2019

Affordable

Very nice service with an affordable premium for travel insurance.

Kinjal Boghara

Mumbai

5th Mar 2019

User Friendly

Quick, easy, and user-friendly process to buy travel insurance.

Abhijeet Doiphode

Pune

6th Feb 2019

Customer Support

Very prompt and professional service. I am pleased with the customer service team at Bajaj Allianz.

Ushaben Pipalia

Ahmedabad

31st Jan 2019

FAQ's

The proposer must be between six months and 60 years old to purchase Travel Prime insurance. The policy is valid for 180 days and can be extended for an additional 180 days.

Personal liability cover under travel care insurance protects you against legal expenses if you unintentionally cause bodily injury to someone or damage their property while travelling. However, it does not cover liabilities involving employees, family members, co-workers, or travel companions. Exclusions include injuries or damages related to busi

This coverage compensates for delays in receiving your checked baggage when travelling to India. To claim, you must obtain a written non-delivery confirmation from the airline stating the delay period. If multiple claims arise during your trip, the total compensation is limited to the sum insured under this section. A 12-hour deductible applies sep

This cover under travel care insurance does not apply in certain cases. It excludes losses due to confiscation or detention by customs, police, or any other authority. Additionally, if the loss is not reported to the police within 24 hours and no official report is obtained, the claim is invalid. It also does not cover losses resulting from neglige

To extend your policy, submit a Good Health Declaration form signed by you. Requests must be made 7 days before the policy’s expiry. Extensions cannot be granted if requested after this period. If there’s a major claim under the current policy, the extension may be approved, but the condition causing the claim will be excluded from coverage in the

When travelling alone, individual travel plan can be a suitable policy. On the other hand, if you are travelling with your famiy then you may opt in for family floater policy.

No, you can opt one policy for the single journey. Please check with your insurance company for more details.

Students can buy a travel insurance policy between the age of 16-35 years as per the policy terms.

You can opt to cancel your plan before or after the policy starts, as outlined in the policy terms. Please note that cancellation rules may vary based on your coverage.

It is advisable to contact your insurance provider to discuss your claim. Please ensure you have your policy details, passport number, and any other relevant information readily available while submitting your claim.

Usually medical reports and their copies, receipts, invoices, FIRs, etc. are required for a domestic travel insurance claim. You can get more information from the customer care executive of your insurer.

You can register your claim in two ways—online and offline. For online claim settlement, visit the insurance provider's website to register your claim and upload the necessary documents. If you prefer offline claim settlement, you can register your claim by contacting the designated person.

Some travel insurance policies may offer renewal options, but this is not always standard. Generally, travel insurance is designed for specific trip durations. It is best to check with your insurance provider to see if renewal is possible and under what conditions.

Extending a travel insurance plan depends on the specific policy and provider. Some policies may allow extensions under certain circumstances, while others may require purchasing a new policy. Contacting your insurance provider directly is the best way to determine if an extension is possible or not.

If your travel insurance expires while you are still traveling, you will no longer have coverage for any medical emergencies, lost luggage, or other risk. This means you would be responsible for any expenses incurred during your travel after your policy expiration. It is recommended to ensure your travel insurance covers the entire duration of your

The validity period of travel insurance varies significantly. It is tied to the length of your trip, and policies are typically purchased for specific durations. These durations can range from a few days to several months, depending on the policy and provider. Always confirm the exact validity period with your insurance provider before your trip.

Why juggle policies when one App can do it all?

Download Caringly Yours App!