Health is not valued until sickness, illness, or any uncalled emergency hits. The importance of having medical insurance is understood more than ever during the pandemic. A common query that people in some parts of our country has is

what is health insurance? In simple words, it is a way through which a financial cover is offered against any uncalled medical emergencies or health-related treatment.

Has this question ever crossed your mind does everyone needs health insurance? There are still so many questions that revolve around it? For instance, anyone who smokes should consider buying it or what is the right age to buy it, etc. In this article, we have discussed the key health insurance benefits briefly.

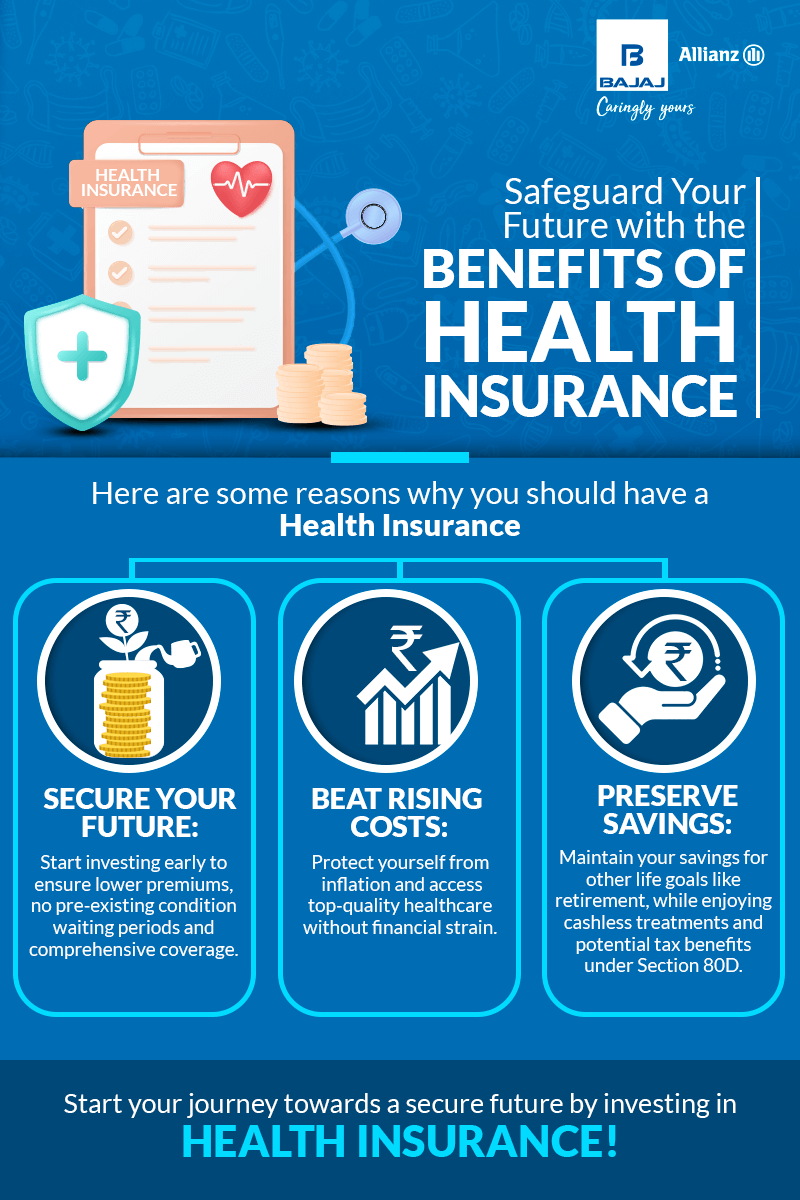

Why Should You Have a Health Insurance?

Here's a rundown that highlights the importance of having a health insurance plan in India:

Securing the Future:

Anyone who is at a younger age or has started their career should consider investing in a health insurance plan. One of the many advantages of purchasing medical insurance online is that you can avail of it at a cost-effective premium rate. Most policies have a pre-existing waiting period, which will end while they are young and mostly suffer no critical illness.

Beat Medical Inflation:

With the advent of medical technology and new treatments, medical expenses have also risen. It includes not just hospitalization but doctor's consultation, diagnosis tests, operation theatre costs, medicines, room rent, etc. With an individual health insurance policy, you can beat the burden of medical inflation while choosing the best quality treatments without being worried.

Safeguard Your Savings:

Manage your medical expenditure without dipping into your savings. With cashless treatment, no need to wait for reimbursements. Your savings can be used for their intended plans, such as buying a home, your child's education, and retirement. Additionally, health insurance provides some tax benefits under Section 80D of the Income Tax Act,1961.

*Tax benefits are subject to change as per the prevailing laws.

Which is the Right Health Insurance Plan to Buy?

If you are single with no dependents you can consider choosing an individual comprehensive health insurance plan. The

health insurance plans for family provide an option to cover yourself and your family members. Moreover, you also have the option to opt for plans dedicate to senior citizens.

Yes, you read it right. The insurance companies in India offer health insurance for senior citizens that acts as a backbone against their vulnerability to critical illnesses and old age problems. It also helps them to shield their lifetime savings. Regardless of the age group, having mediclaim insurance in place helps you in the crisis hour.

Is Health Insurance Necessary for Critical Illness?

At times diseases come our way and spoil our future investment plans. There are chances that an individual may be diagnosed with any critical illnesses such as cancer, tumors, etc. The high-cost treatments, hospitalization bills, and expensive drugs can deplete all the earnings. It can easily put a financial strain on the individual or family for a lifetime. Ensure that you assess the health insurance needs and take into consideration the aspect of the future too. You may also consider opting for

Critical illness insurance that offers cover when diagnosed with any such illness as per the policy terms and conditions.

Moreover, Regardless of whether you are a smoker or non-smoker going with a health insurance plan is a must. Various parameters determine the health insurance premium. The premium cost is generally on the higher side if you smoke when compared to a non-smoker. Staying uninsured can cost you more heavily in the future. Moreover, for a healthier life, it's better to quit smoking and lead a better lifestyle.

*Standard T&C apply

The Bottom Line

A health insurance policy is important considering the sedentary lifestyle we lead. Before you buy a suitable plan, ensure to read the terms and conditions offered within it.

Make an informed decision and secure yourself and your loved ones from any adversity that may leave you handicapped financially.

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

Service Chat: +91 75072 45858

Service Chat: +91 75072 45858