Buying a new car is often one of the milestones of the buyer’s life, a happy moment for them and their family. But there is more to owning a car than simply buying it and driving it. Your vehicle is one of your prized possessions and must be taken care of. When it is in your possession, there are several possibilities you may face that may cause harm to it. While some of these situations may be unavoidable, you can still get financial protection against them. This can be achieved if you

buy car insurance online or offline for your new car.

Oftentimes, you may not even have to buy your new car insurance policy. If you are buying a new car, the dealer may throw an insurance plan in the package being offered to you. You may choose to opt for the policy offered by the dealer, or you can choose to buy car insurance yourself, as per your convenience and preference.

But how to decide which insurance policy to buy and whether it is right for you? There are a few factors you ought to consider before buying a new car insurance policy. It will help you choose the right plan and offer the right coverage for your vehicle.

Before we dive into which factors to consider when buying a new car insurance plan, let’s first understand why buying car insurance is a crucial step when it comes to protecting your car and taking care of it.

Importance of car insurance

There are a few different types of car insurance plans available in the market. The most basic one of these is the third-party liability cover. It is the plan that covers any damage caused to a third party in a situation where you are involved. This would mean that you are not required to pay for any damages from your pocket. Instead, such damages would fall within the scope of your policy and will be covered by the insurance provider.

Moreover, there is no other choice but to get a

third-party liability cover. According to the

Motor Vehicles Act, 1988, all vehicle owners are required to get at least a third-party liability cover. If they fail to do so, they may be penalised for the same.

Besides this basic car insurance cover, there are many other

types of car insurance available. It may not be mandatory to have these, but it is recommended that you get them to maximise your protection against any unfortunate incidents. These covers include collision or own damage cover, personal accident cover, and more.

You can either choose to buy each of these policies separately or take a

comprehensive car insurance policy that will offer you a bundle of these covers.

Thus, every vehicle owner must know that buying new car insurance is not only necessary, but also mandatory. You should know in detail what each policy offers, and which ones you need, aside from the third-party liability cover, which is mandatory. If you are worried about how much you will have to pay for the car insurance cover you seek, you can get estimates for the same using an online

car insurance calculator. * Standard T&C Apply

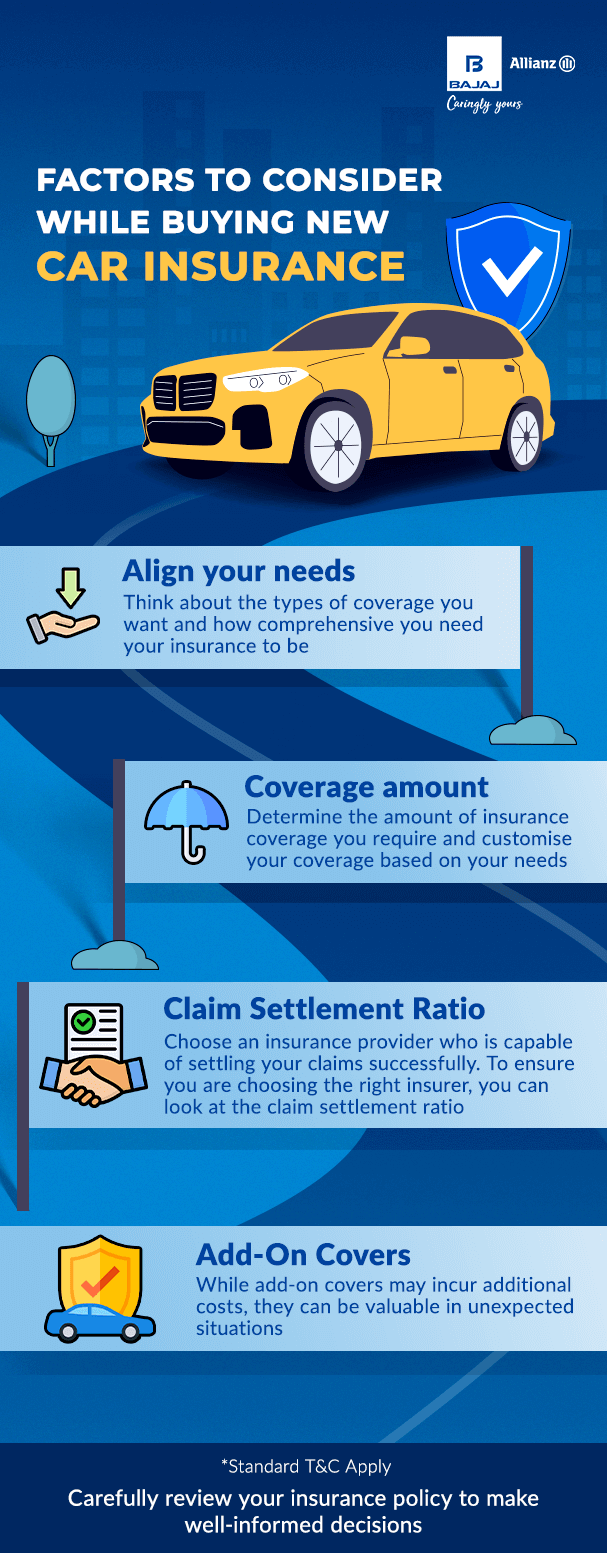

What factors to consider when buying new car insurance?

Buying a new car insurance policy is a significant decision. It offers financial protection for your car. Hence, it is not a decision to be taken in haste. Here are a few factors to consider when you

buy car insurance online or offline.

Your needs

There are a number of choices you will need to make when getting a car insurance policy. For example, which type of covers do you seek, how comprehensive do you want your insurance coverage to be, and more. Consider all your requirements before you settle on a policy. *

Coverage

Think of how much insurance coverage you need. Are you happy with the mandatory third-party liability cover, or do you want more? It is advisable to have as many covers as possible. Opt for the coverage amount and the type of cover accordingly. *

Claim settlement ratio

You want to choose an insurance provider who is capable of settling your claims successfully. To ensure you are choosing the right insurer, you can look at the claim settlement ratio. It is a value that tells you about the claims successfully settled by the insurer, as compared to the claims received by them. Ideally, you should choose a provider with a high claim settlement ratio. *

Add-on covers

Add-on covers come with an additional cost but can prove to be quite useful if you were to face any unusual situations. Choose add-on covers carefully, in a way that it enhances your plan without the cost becoming a burden to you.*

Apart from these factors which you must consider when buying car insurance, remember to study your plan carefully. Ensure that you understand the terminology, clauses, and inclusions and exclusions of the plan properly. If not, you may consult an insurance agent or an insurance provider representative.

* Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

Service Chat: +91 75072 45858

Service Chat: +91 75072 45858