સ્વાસ્થ્યને લગતી સમસ્યાઓ અમીર અને ગરીબ વચ્ચે કોઈ ભેદ કરતી નથી. કોઈને ઓછી કે કોઈને વધુ, પણ પ્રત્યેક વ્યક્તિને મેડિકલ સમસ્યાઓ ઉદ્ભવી શકે છે. તે તમારી દૈનિક આદતો અને જીવનશૈલી, તમે જે આરોગો છો, તમારા વ્યસનો અને અન્ય બાબતો પર આધારિત છે. તેથી, રાષ્ટ્રના દરેક નાગરિકની સુરક્ષા માટે, ભારત સરકારે આયુષ્માન ભારત યોજના શરૂ કરી છે. આ કાર્યક્રમ યુનિવર્સલ હેલ્થ કવરેજ પ્રાપ્ત કરવાના દ્રષ્ટિકોણ સાથે શરૂ કરવામાં આવ્યો હતો. આયુષ્માન ભારત યોજનાનો હેતુ "કોઈ બાકી રહી ન જાય" તે માટે તેની અંતર્ગત પ્રતિબદ્ધતા સાથે ટકાઉ વિકાસ માટે છે. આયુષ્માન ભારત યોજના એ ક્ષેત્રીય અને તૂટક અભિગમને બદલીને વ્યાપક જરૂરિયાત આધારિત અભિગમ કરવાનો પ્રયત્ન કરે છે. આયુષ્માન ભારત યોજનાના બે ઘટકો છે -

- હેલ્થ અને વેલનેસ સેન્ટર

- પ્રધાનમંત્રી જન આરોગ્ય યોજના (પીએમજેએવાય)

હેલ્થ અને વેલનેસ સેન્ટર

ભારત સરકારે ફેબ્રુઆરી 2018 માં હાલના પેટા-કેન્દ્રો અને પ્રાથમિક આરોગ્ય કેન્દ્રોને હેલ્થ અને વેલનેસ સેન્ટર્સમાં રૂપાંતરિત કર્યા હતા. તેનો પ્રાથમિક ઉદ્દેશ ગરીબો માટે હેલ્થકેર સુલભ કરાવવાનો અને વધુ ઍક્સેસિબલ બનાવવાનો છે. માતૃત્વ તેમજ બાળ સંભાળ સેવાઓની સાથે મફત નિદાન સેવાઓ અને આવશ્યક દવાઓની ડિલિવરી આ કેન્દ્રોની મુખ્ય વિશેષતા છે.

What is PMJAY (Ayushman Bharat Yojana Scheme)?

Ayushman Bharat, also known as Pradhan Mantri Jan Arogya Yojana (PMJAY), is India’s flagship healthcare scheme launched by Prime Minister Narendra Modi on September 23, 2018. Recognised as the world’s largest government-funded health insurance program, it targets over 50 crore citizens from economically disadvantaged backgrounds. Ayushman health insurance offers coverage of up to INR 5 lakh per family per year for secondary and tertiary care, ensuring access to both private and public hospitals. The scheme covers hospitalisation expenses and ensures a cashless, paperless experience for beneficiaries. Aimed at providing financial protection against high medical costs, Pradhan Mantri health insurance is a key initiative to improve healthcare access for the underprivileged, transforming India’s healthcare landscape.

Features of Ayushman Bharat Yojana Scheme

The Ayushman Bharat Yojana comes with several features that set it apart from traditional healthcare programs. Some of the prominent features include:

- Cashless hospitalisation across government and private hospitals.

- Comprehensive coverage for pre-hospitalisation, hospitalisation, and post-hospitalisation costs.

- Coverage for approx. 1,929 procedures

- No restrictions based on family size, gender, or age.

- Pre-existing conditions are covered from day one.

- The Ayushman Bharat health insurance scheme is aimed at families from vulnerable sections of society, providing them with access to quality healthcare without worrying about out-of-pocket expenses.

આયુષ્માન ભારત યોજના સ્કીમના લાભો

- પીએમજેએવાય યોજના હૉસ્પિટલાઇઝેશન પહેલાના 3 દિવસ સુધી અને હૉસ્પિટલાઇઝેશન પછીના 15 દિવસ સુધીના ખર્ચને આવરી લે છે, જેમાં નિદાન અને દવાઓનો ખર્ચ શામેલ છે.

- કુટુંબના સભ્યોની સંખ્યા, ઉંમર અથવા જાતિ (સ્ત્રી/પુ.) આધારિત કોઈ પ્રતિબંધ નથી.

- કોઈપણ માટે કવરેજ અગાઉથી હોય તેવા રોગ પ્રથમ દિવસથી. ના વેટિંગ પીરિયડ.

- ડે-કેર ખર્ચને પણ આવરી લેવામાં આવે છે.

- સ્કીમ હેઠળ નોંધાયેલા લોકો માટે પેપરલેસ સુવિધા સાથે કૅશલેસ હેલ્થ ઇન્શ્યોરન્સ ઉપલબ્ધ.

- પીએમજેએવાય હેઠળની સુવિધાઓનો લાભ સમગ્ર દેશમાં ઉપલબ્ધ છે.

Regular Health Insurance Plans vs Government Health Insurance Scheme

While regular health insurance plans are designed to cater to a wide range of individuals, Pradhan Mantri health insurance specifically targets the economically weaker sections of society. Traditional health insurance plans often require policyholders to pay premiums, have exclusions for pre-existing conditions, and may involve long waiting periods for claims. In contrast, PMJAY is a government-funded scheme with no premiums and immediate coverage for pre-existing conditions. Additionally, health insurance Ayushman Bharat has a higher coverage amount for families, providing up to INR 5 lakh per year for healthcare needs, including surgery, diagnostics, and critical care.

ગ્રામીણ અને શહેરી વસ્તી માટે પીએમજેએવાય પાત્રતાના માપદંડ

આયુષ્માન ભારત યોજનાનો હેતુ દસ કરોડથી વધુ પરિવારોને લાભ આપવાનો છે, જેમાં 50 કરોડથી વધુ વ્યક્તિઓનો સમાવેશ થાય છે, તેમાં શહેરી અને ગ્રામીણ વસ્તી માટે અલગ-અલગ માપદંડો છે.

PMJAY રૂરલ

ગ્રામીણ વિસ્તારમાં હેલ્થ કેર સુવિધાઓની સુલભતા એ ચિંતાનો મોટો વિષય છે, જે તબીબી આરોગ્યસંભાળના વધતા ખર્ચ સાથે વધતી જાય છે. ઘણીવાર એવું જોવામાં આવે છે કે લોકોને મોટા તબીબી બિલની ચુકવણી કરવા માટે કર્જ લેવું પડતું હોય છે.

ગ્રામીણ વિસ્તારોમાં પીએમજેએવાયનો લાભ નીચે જણાવેલ પ્રકારના લોકો લઈ શકે છે -

- 16 થી 59 વર્ષની ઉંમરના એકપણ પુરુષ સભ્ય ન હોય તેવા પરિવારો.

- 16 થી 59 વર્ષની ઉંમરના એકપણ પુખ્ત ન હોય તેવા પરિવારો.

- વિકલાંગ સભ્ય ધરાવતા પરિવાર અને વિકલાંગ ન હોય તેવા એકપણ પુખ્ત વયના સભ્યો ન હોય તેવા પરિવાર.

- અનુસૂચિત જાતિ અને અનુસૂચિત જનજાતિના ઘરો.

- જમીન ન હોય તેવા કુટુંબો, જેમની મુખ્ય આવક જાત-મજૂરીમાંથી આવે છે.

- કામચલાઉ દીવાલો અને છાપરાવાળા એક રૂમના ઘરમાં રહેતા પરિવારો.

- મેન્યુઅલ સ્કેવેન્જર્સ તરીકે કામ કરતા પરિવારો.

- ઘરવિહોણા પરિવારો.

- અસલ આદિવાસી જૂથ.

- કાયદેસર રીતે રિલીઝ કરેલ બોન્ડેડ લેબર.

- અત્યંત ગરીબીમાં રહેતા કે માંગીને ગુજરાન ચલાવતા વ્યક્તિઓ.

PMJAY અર્બન

એક

₹5 લાખનો ઇન્શ્યોરન્સ પરિવાર દીઠ કવર, આયુષ્માન ભારત સ્કીમ શહેરી પ્રદેશોમાં નીચેની કેટેગરીના લોકોને લાભ આપશે -

- કચરો વીણનાર

- ભિક્ષુકો

- ઘરેલું કામદારો

- શેરી વિક્રેતાઓ, મોચી કે ફેરિયાઓ અથવા ફૂટપાથ પર સેવાઓ પ્રદાન કરતી અન્ય વ્યક્તિઓ.

- બાંધકામના કામદારો, પ્લમ્બર, મજૂર, પેઇન્ટર્સ, વેલ્ડર્સ, સિક્યોરીટી ગાર્ડ્સ

- સ્વીપર અને સફાઇ કામદારો

- વાહનવ્યવહારની સેવાઓ સાથે સંકળાયેલા વ્યક્તિઓ જેમ કે ડ્રાઇવર, કંડક્ટર, હેલ્પર, લારી અથવા રિક્ષા ખેંચનાર તથા માથે ભાર ઉંચકતા વ્યક્તિઓ.

- ઘરેથી કામ કરનાર કામદારો, દરજીઓ અને હસ્તકલા કામદારો સહિતના કારીગરો.

- દુકાનમાં કામ કરતા કામદારો, નાની સંસ્થાઓમાં મદદનીશો અથવા પટાવાળા, ડિલિવરી બોય અને વેઇટર.

- વૉશર-મેન અથવા ચોકીદાર.

તદુપરાંત, રાષ્ટ્રીય સ્વાસ્થ્ય બીમા યોજના (આરએસબીવાય) હેઠળ શામેલ પરિવારોને પણ આ યોજના હેઠળ આવરી લેવામાં આવશે.

આ પણ વાંચો: ભારતમાં સરકારી વીમા યોજનાઓ

Who is Not Eligible for the Ayushman Bharat Yojana?

While Ayushman Bharat Yojana aims to provide health insurance coverage to the most vulnerable sections of society, individuals from higher-income households or those who do not meet the specific eligibility criteria may not qualify for the scheme. For instance, families that own luxury goods, have higher annual income levels or belong to the wealthier categories of society might not be eligible.

What is Covered Under the Ayushman Bharat Yojana Scheme?

Ayushman Bharat Yojana covers a wide range of healthcare services, including:

- Medical consultation and treatment.

- Surgical procedures, including critical surgeries.

- Pre-hospitalisation and post-hospitalisation expenses.

- Medicines and diagnostic tests.

- Room charges, ICU fees, and other medical consumables.

- COVID-19 treatment.

- Maternity services and neonatal care.

આયુષ્માન ભારત યોજના સ્કીમ હેઠળ શું કવર કરવામાં આવતું નથી?

નીચે જણાવેલ વ્યક્તિઓ અથવા કુટુંબોને પીએમજેએવાયથી બાકાત રાખવામાં આવશે -

- બ્રેકેટ હેઠળ આવતું અને આવકવેરા અથવા વ્યવસાય વેરો ચૂકવતું કોઈપણ કુટુંબ.

- કોઈ સભ્ય સરકારી કર્મચારી હોય તેવા કુટુંબો.

- સરકાર સાથે નોંધાયેલા બિન-કૃષિ ઉદ્યોગોમાં કાર્યરત લોકો.

- કુટુંબના કોઈપણ સભ્યની માસિક આવક ₹10,000 કરતાં વધુ હોય.

- ₹50,000 ની ક્રેડિટ મર્યાદા સાથે કિસાન કાર્ડ ધરાવતા કુટુંબો.

- ટુ, થ્રી અથવા ફોર-વ્હીલર ધરાવતા અથવા મોટરાઇઝ્ડ ફિશિંગ બોટ ધરાવતા વ્યક્તિઓ.

- રેફ્રિજરેટર્સ અને લેન્ડલાઇન ફોન્સ ધરાવતા કુટુંબો.

- સિંચાઈના ઉપકરણો સાથે 2.5 એકરથી વધુ જમીનની માલિકી ધરાવતા લોકો.

- પાકા ઘરમાં રહેતા વ્યક્તિઓ.

List of Critical Diseases or Illnesses Covered Under Ayushman Bharat Yojana Scheme

Prime minister's health insurance scheme includes a broad list of critical illnesses, such as:

- પ્રોસ્ટેટ કૅન્સર.

- Coronary artery bypass graft(CABG).

- Pulmonary valve replacement.

- Organ transplants, including kidney and liver transplants.

- Burn-related injuries.

પીએમજેએવાય નોંધણી પ્રક્રિયા

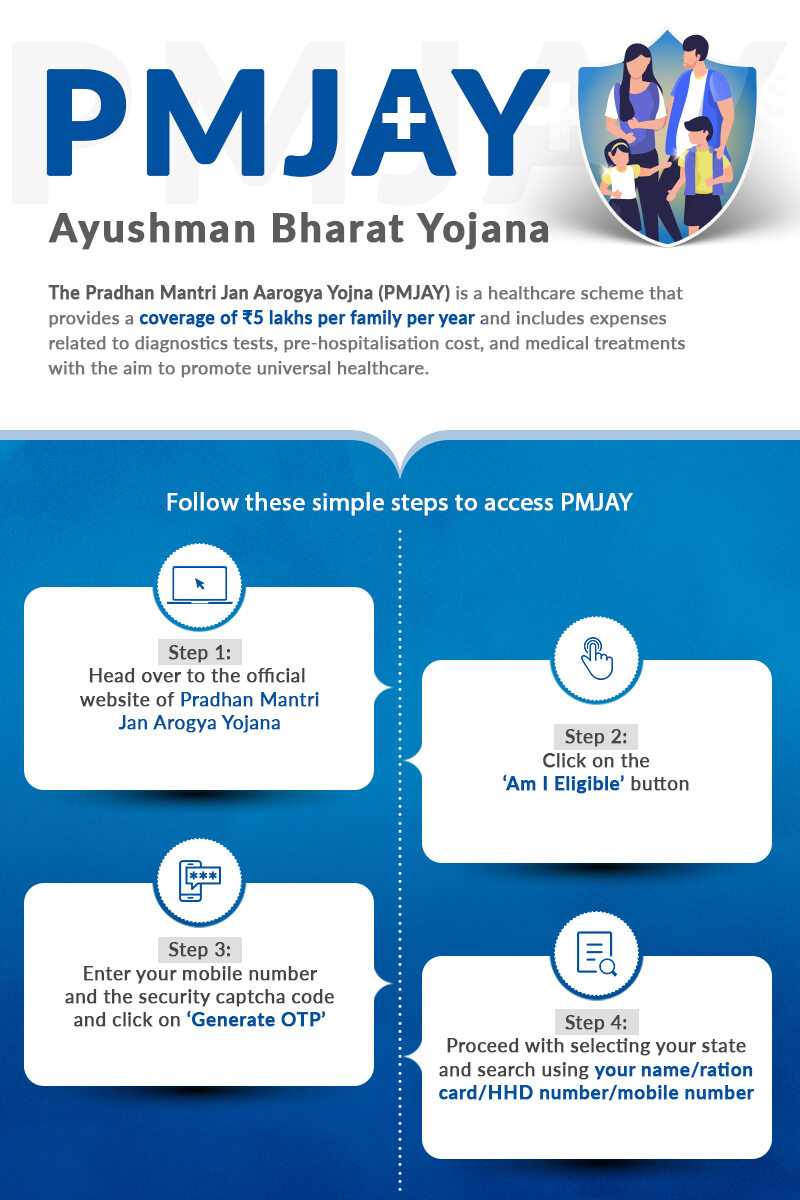

The enrollment process for the Ayushman Bharat insurance registration is simple and straightforward. There is no need for a formal application. Eligible beneficiaries are selected through a government database based on socio-economic status. To check eligibility:

- Visit the official website of PMJAY

- Click on the “Am I Eligible” section.

- Enter details such as your name, mobile number, or ration card number.

- A result will display whether you are eligible for the scheme.

Documents Required to Apply For Ayushman Bharat Yojana Scheme

To apply for Pradhan Mantri medical insurance, you will need to provide the following documents:

- Identity proof (Aadhaar card, PAN card).

- રહેઠાણનો પુરાવો.

- Income certificate.

- Caste certificate (if applicable).

- Ration card or Household Identification Number (HHD).

How To Apply Online For Ayushman Bharat Yojana?

Ayushman Bharat health insurance apply online by following these steps:

- Visit the official PMJAY website.

- Select the “Am I Eligible” section.

- Provide your contact details and generate OTP.

- Check the results for eligibility.

How To Download Ayushman Bharat Yojana Card Online?

To download your Ayushman Bharat health insurance card online:

- Visit the PMJAY website.

- Enter your registered mobile number and OTP.

- Provide Household ID or Ration card number.

- Pay a nominal fee of INR 30 at the Common Service Centre to get your card.

How to Check Ayushman Bharat Yojana Eligibility Online

To check your eligibility for the Ayushman Bharat Yojana:

- Visit the official PMJAY website.

- Enter your personal details, such as name or ration card number.

- Verify eligibility results online.

Common Treatments Covered Under PMJAY

Some of the most common treatments covered under the Ayushman Bharat health insurance scheme include:

- Maternity services

- Cancer treatments

- Cardiac surgeries

- Orthopaedic treatments

Hospitalisation Process in Ayushman Bharat Scheme (PMJAY)

Once a beneficiary is enrolled in Pradhan Mantri Jan Arogya Yojana (PMJAY), they can avail cashless treatment at any of the empanelled public or private hospitals. The beneficiary needs to present their PMJAY card at the time of hospitalisation, and the treatment costs will be covered under the scheme. No payment is required from the beneficiary at the time of admission or discharge, as the scheme ensures seamless reimbursement.

How to Find PMJAY Hospital List?

To find the list of empanelled hospitals under Ayushman Bharat Yojana, visit the official website of PMJAY:

- Select your state and district.

- Choose the type of hospital (public or private).

- Enter the Captcha code and search for hospitals near you.

વારંવાર પૂછાતા પ્રશ્નો

What is the income limit for the Ayushman card?

There is no specific income limit set for Ayushman Bharat beneficiaries. The scheme is aimed at providing health coverage to economically weaker sections of society. Families are selected based on socio-economic data gathered by the Socio-Economic Caste Census (SECC) and other eligibility criteria rather than income thresholds.

What is the income proof for the Ayushman card?

Ayushman Bharat health insurance card apply online includes proof of income can be provided through various documents that validate the economic status of the family. Common documents include an income certificate issued by government authorities, a ration card that specifies family details, or other documents such as landholding papers, which indicate socio-economic status.

Is the Ayushman card valid for all family members?

Yes, the Ayushman Bharat card is valid for all family members listed in the application. Once registered, the entire family can avail the benefits of the Ayushman Bharat health insurance scheme, which covers secondary and tertiary care for each eligible member. It ensures comprehensive healthcare coverage for everyone in the family.

Is Ayushman card can be used in private hospitals?

Yes, the Ayushman Bharat health insurance card can be used in empanelled private hospitals for cashless treatment. The scheme provides beneficiaries with access to both public and private healthcare facilities that are part of the PMJAY network, ensuring that beneficiaries can receive treatment at high-quality hospitals without any financial burden.

Is Ayushman Bharat free for everyone?

No, Ayushman Bharat is not free for everyone. The scheme is specifically designed to assist economically weaker sections of society. It provides free health insurance to families identified under the Socio-Economic Caste Census (SECC). It is aimed at providing financial protection to underprivileged families who struggle to afford quality healthcare services.

Can I apply for PMJAY offline?

Yes, Pradhan Mantri Jan Arogya Yojana (PMJAY) applications can be processed offline. Eligible individuals can visit Common Service Centres (CSCs) or approach empanelled hospitals for offline registration. The process involves submitting the necessary documents, such as an Aadhaar card and income certificate, and receiving assistance in filling out the forms for eligibility determination.

Is there any premium for PMJAY?

No, there is no premium required for participating in the Ayushman Bharat health insurance scheme. Since PMJAY is a government-funded scheme, beneficiaries do not need to pay any premium fees. The scheme is financed by the Government of India and provides free healthcare coverage for eligible families, ensuring that financial constraints do not hinder access to medical treatment.

How to update data in PMJAY?

To update your data in PMJAY, you can visit your nearest Common Service Centre (CSC). These centres can assist with updating personal details like address, mobile number, or family information. Alternatively, you can also contact the PMJAY helpline at 1800-111-565 or 14555 for guidance on updating your details through official channels.

Does PMJAY cover people above the age of 80 years?

Yes, Ayushman Bharat covers individuals above the age of 80 years. There are no age restrictions for eligibility under the PMJAY scheme. It provides coverage for senior citizens, irrespective of their age, ensuring that the elderly also have access to medical services, including secondary and tertiary care, at empanelled hospitals nationwide.

Does Ayushman Bharat cover orthopaedics treatment?

Yes, Ayushman Bharat health insurance covers a wide range of orthopaedic treatments, including surgical procedures. This includes treatments for fractures, joint replacements, and other orthopaedic conditions. Beneficiaries can avail of cashless treatment for orthopaedic surgeries at empanelled private and public hospitals under the PMJAY scheme.

Does PMJAY cover pre-existing diseases?

Yes, PMJAY covers pre-existing diseases from day one of enrollment. The scheme ensures that beneficiaries with pre-existing medical conditions are eligible for treatment. Whether it’s diabetes, hypertension, or any other chronic illness, Ayushman Bharat health insurance covers the cost of treatment for these conditions from the moment you join the scheme, with no waiting period.

How can I find my Household ID number for PMJAY?

To find your Household ID number (HHD) for PMJAY, you can check your ration card or refer to the PMJAY website. The HHD number is a unique 25-character code that identifies households eligible for the scheme. You can also visit Common Service Centres (CSCs) to get assistance in retrieving your Household ID number for registering or checking eligibility.

*સ્ટાન્ડર્ડ નિયમો અને શરતો લાગુ

ઇન્શ્યોરન્સ એ આગ્રહની વિષયવસ્તુ છે. લાભો, બાકાત, મર્યાદાઓ, નિયમો અને શરતો વિશે વધુ વિગતો માટે, કૃપા કરીને વેચાણ પૂર્ણ કરતા પહેલાં સેલ્સ બ્રોશર/પૉલિસી નિયમાવલીને કાળજીપૂર્વક વાંચો.

***ડિસ્ક્લેમર: આ પેજનું કન્ટેન્ટ સામાન્ય છે અને માત્ર માહિતીપૂર્ણ અને સ્પષ્ટીકરણના હેતુઓ માટે શેર કરવામાં આવેલ છે. તે ઇન્ટરનેટ પરના કેટલાક સેકન્ડરી સ્રોતો પર આધારિત છે અને તે ફેરફારોને આધિન હોય છે. કોઈપણ સંબંધિત નિર્ણયો લેતા પહેલાં, કૃપા કરીને નિષ્ણાતની સલાહ લો.

સર્વિસ ચૅટ:

સર્વિસ ચૅટ: